Did you know that you might still qualify for a $1,400 stimulus check from the IRS? Many individuals are missing out on this opportunity because they are either unaware or unsure about how to proceed. The IRS has taken significant steps to ensure eligible taxpayers receive their payments. However, it is essential for you to take the necessary actions to claim what is rightfully yours.

In this detailed guide, we will explore everything you need to know about claiming your $1,400 stimulus check. We will cover eligibility requirements, the step-by-step process of claiming the payment, and address common questions and concerns. By the end of this article, you will have a clear understanding of how to proceed and ensure you receive your rightful payment.

The IRS continues to support individuals who may have missed out on earlier rounds of stimulus payments. Whether you are a low-income individual, a non-filer, or someone who has recently become eligible, this article will provide you with the necessary guidance to claim your $1,400 stimulus check.

Read also:Understanding Usaid A Comprehensive Guide To Its Role And Impact

Below is a table of contents to help you navigate through the article easily:

- Who Qualifies for the $1,400 Stimulus Check?

- How to Claim the $1,400 Stimulus Check

- Special Guidance for Non-Filers

- The Importance of Tax Returns in Stimulus Payments

- IRS Tools to Track Your Payment

- Answers to Common Questions About Stimulus Checks

- Who Can Receive Stimulus Payments?

- Recovery Rebate Credit for Missed Payments

- Protect Yourself from Stimulus Check Scams

- Conclusion

Who Qualifies for the $1,400 Stimulus Check?

Eligibility for the $1,400 stimulus check is determined by specific income thresholds and other criteria. To qualify, your adjusted gross income (AGI) must fall within certain limits. For single filers, the phase-out begins at $75,000 and ends at $80,000. For married couples filing jointly, the phase-out starts at $150,000 and ends at $160,000.

One notable change in this round of stimulus payments is the inclusion of dependents of all ages. Unlike previous rounds, where only dependents under 17 were eligible, this update ensures that more families benefit from the stimulus package. Whether you have young children or adult dependents, they may qualify for the $1,400 payment.

Here is a summary of eligibility criteria:

- Single filers with AGI up to $80,000

- Married couples filing jointly with AGI up to $160,000

- Dependents of all ages

For more detailed information, refer to the IRS website or consult with a tax professional to ensure you meet all the requirements.

How to Claim the $1,400 Stimulus Check

Step-by-Step Guide to Claiming Your Payment

If you have not yet received your stimulus payment, you may need to take action to claim it. Follow these steps to ensure you receive your payment promptly:

Read also:Exploring The Mystical Realm Of The 33 Immortals

- Review your eligibility based on your income and filing status.

- Check the status of your payment using the IRS "Get My Payment" tool.

- File your 2020 tax return if you have not done so already, as it is crucial for determining your eligibility.

- Claim the Recovery Rebate Credit on your tax return if you qualify.

Taking these steps will help ensure that you receive your payment without unnecessary delays. It is important to act quickly, as there may be deadlines for claiming the credit.

Special Guidance for Non-Filers

How Non-Filers Can Claim Their Stimulus Check

If you do not typically file taxes, you may still qualify for the $1,400 stimulus check. The IRS has created special provisions for individuals who do not regularly file tax returns, including:

- Social Security recipients

- Supplemental Security Income (SSI) recipients

- Veterans receiving benefits

Non-filers can use the IRS Non-Filers tool to register for their payment. This tool simplifies the process, ensuring eligible individuals receive their stimulus check without needing to file a full tax return. By utilizing this resource, non-filers can avoid missing out on their rightful payment.

The Importance of Tax Returns in Stimulus Payments

Why Filing Your Taxes is Essential

Your tax return plays a critical role in determining your eligibility for the $1,400 stimulus check. The IRS uses information from your 2020 or 2019 tax return to calculate your payment amount. If you have not yet filed your 2020 return, it is important to do so as soon as possible to ensure accurate processing of your stimulus payment.

In addition to helping you claim your stimulus payment, filing your taxes can also allow you to claim other credits and deductions that may increase your refund. If you need assistance with filing your return, consider consulting a tax professional to ensure accuracy and completeness.

IRS Tools to Track Your Payment

Using the "Get My Payment" Tool

The IRS offers an online tool called "Get My Payment" that allows you to track the status of your stimulus payment. This tool is available on the IRS website and requires you to enter your Social Security number, date of birth, and filing status. It will provide updates on your payment, including expected delivery dates.

When using the "Get My Payment" tool, be cautious of third-party tools or websites, as they may not be secure or accurate. Always rely on official IRS resources to avoid scams or fraudulent activity.

Answers to Common Questions About Stimulus Checks

Frequently Asked Questions About Stimulus Payments

Here are answers to some of the most common questions about the $1,400 stimulus check:

- Q: Can I receive a stimulus check if I owe back taxes?

A: Yes, the stimulus payment is not offset by back taxes or federal debts. - Q: What if I missed the deadline to file my 2020 tax return?

A: You can still file a late return to claim the Recovery Rebate Credit. - Q: How long will it take to receive my payment?

A: Payment times vary depending on the method of delivery and your individual circumstances.

For more detailed answers, refer to the IRS FAQs section or consult with a tax professional.

Who Can Receive Stimulus Payments?

Eligible Recipients and Key Exceptions

In addition to individual taxpayers, several groups are eligible for the $1,400 stimulus check. These include:

- Dependents of all ages

- U.S. citizens living abroad

- Resident aliens who file joint returns with U.S. citizens

However, some individuals may not qualify, such as those who are claimed as dependents on someone else's tax return. Understanding these nuances is important to ensure you meet the criteria for receiving a payment. If you are unsure about your eligibility, consult the IRS website or a tax professional for clarification.

Recovery Rebate Credit for Missed Payments

How to Claim Unreceived Stimulus Payments

If you believe you missed out on previous stimulus payments or did not receive the full amount, you can claim the Recovery Rebate Credit on your 2020 tax return. This credit allows you to recover any payments you may have missed or were underpaid.

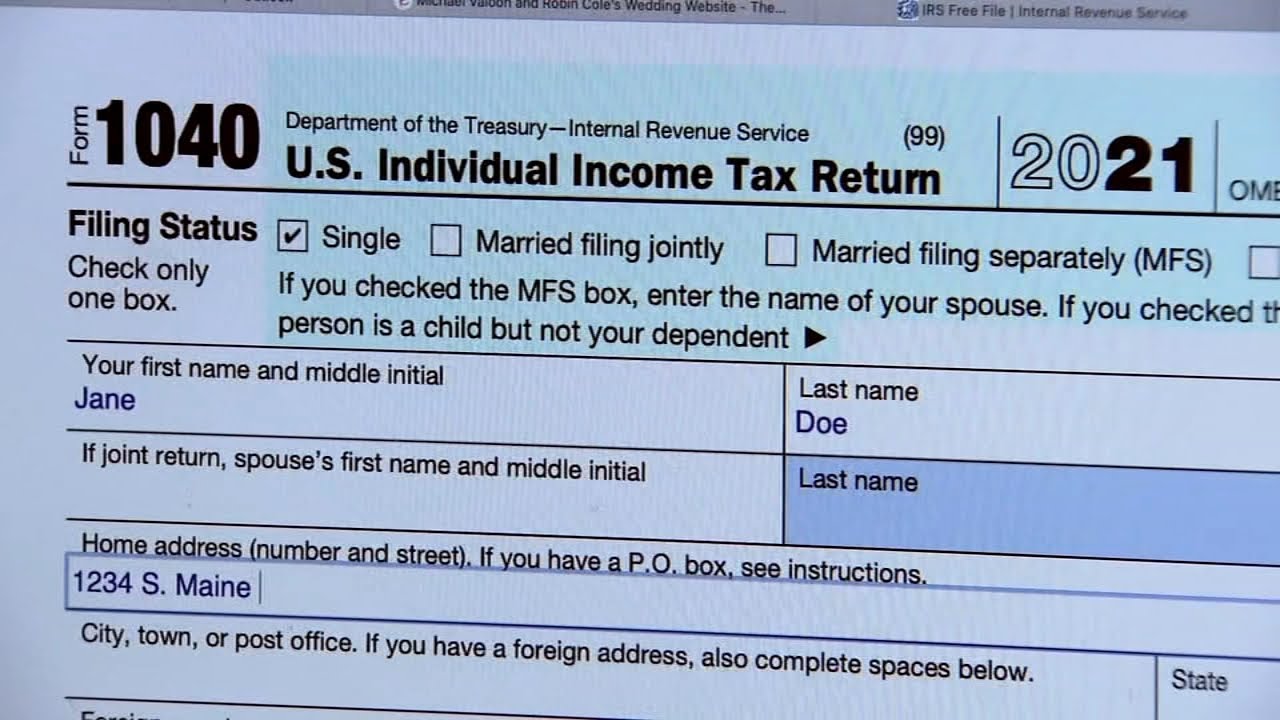

To claim the credit, complete IRS Form 1040 or 1040-SR and include the necessary documentation. The IRS will review your claim and issue any additional payments owed to you. Filing for the Recovery Rebate Credit is a straightforward process that can help you secure the payments you deserve.

Protect Yourself from Stimulus Check Scams

How to Avoid Fraudulent Activity

With the widespread attention on stimulus payments, scammers are taking advantage of the situation to steal personal information and money. Be cautious of unsolicited calls, emails, or texts claiming to help you claim your stimulus check. The IRS will never contact you via these methods to request personal or financial information.

To protect yourself, follow these tips:

- Only use official IRS resources to track or claim your payment.

- Do not provide personal information to unknown parties.

- Report any suspicious activity to the IRS or local authorities.

Stay informed and vigilant to avoid falling victim to scams. By being proactive, you can safeguard your personal information and ensure you receive your rightful payment.

Conclusion

In conclusion, it is not too late to claim your $1,400 stimulus check from the IRS. By understanding the eligibility criteria, following the proper steps, and utilizing official IRS tools, you can ensure that you receive your payment. Remember to file your tax return if necessary and claim the Recovery Rebate Credit if you missed previous payments.

We encourage you to take action today and secure your rightful stimulus payment. If you found this article helpful, please share it with others who may benefit from the information. Additionally, feel free to leave a comment or question below, and we will do our best to assist you further.

Sources:

- IRS.gov

- Treasury Department

- National Taxpayer Advocate