The IRS has successfully distributed the third round of stimulus checks, providing up to $1,400 per person to millions of Americans. This financial assistance aims to alleviate the economic hardships caused by the ongoing pandemic. If you haven't received your stimulus check yet, it's essential to understand the eligibility requirements and steps to verify your status.

The $1,400 stimulus check is part of the American Rescue Plan Act, enacted in March 2021, designed to support individuals and families facing financial challenges. While millions have already received their payments, not everyone qualifies. Gaining a clear understanding of the eligibility criteria is critical to ensuring you are entitled to this aid.

This article will provide a detailed overview of the stimulus check program, including eligibility guidelines, methods to check your status, and steps to take if you haven't received your payment. Additionally, we'll offer practical advice and resources to help you navigate the process effectively.

Read also:Exploring Naomi Osakas Journey Achievements Advocacy And Legacy

Table of Contents

- Overview of the $1,400 Stimulus Check

- Who Qualifies for the Stimulus Check?

- How to Track Your Stimulus Check

- Dependent Eligibility and Payment Details

- How Your Tax Return Affects Eligibility

- Steps to Take If You Haven't Received Your Payment

- Answers to Common Questions About the Stimulus Check

- Protect Yourself from Stimulus Check Scams

- Will There Be Additional Stimulus Payments?

- Conclusion and Next Steps

Overview of the $1,400 Stimulus Check

The $1,400 stimulus check represents a direct financial aid initiative by the federal government under the American Rescue Plan Act. This act was specifically crafted to address the widespread economic difficulties caused by the global pandemic. The funds are intended to assist individuals and families in managing essential expenses such as rent, groceries, and medical bills.

Eligible recipients include individuals earning up to $75,000 annually, heads of households earning up to $112,500, and married couples with joint incomes up to $150,000. Payments start to decrease above these thresholds, phasing out entirely for individuals earning over $80,000, heads of households earning over $120,000, and couples earning over $160,000.

Key Facts About the Stimulus Check

- The payment amount is $1,400 per eligible individual.

- For the first time, adult dependents are eligible for payments, in addition to children under 17.

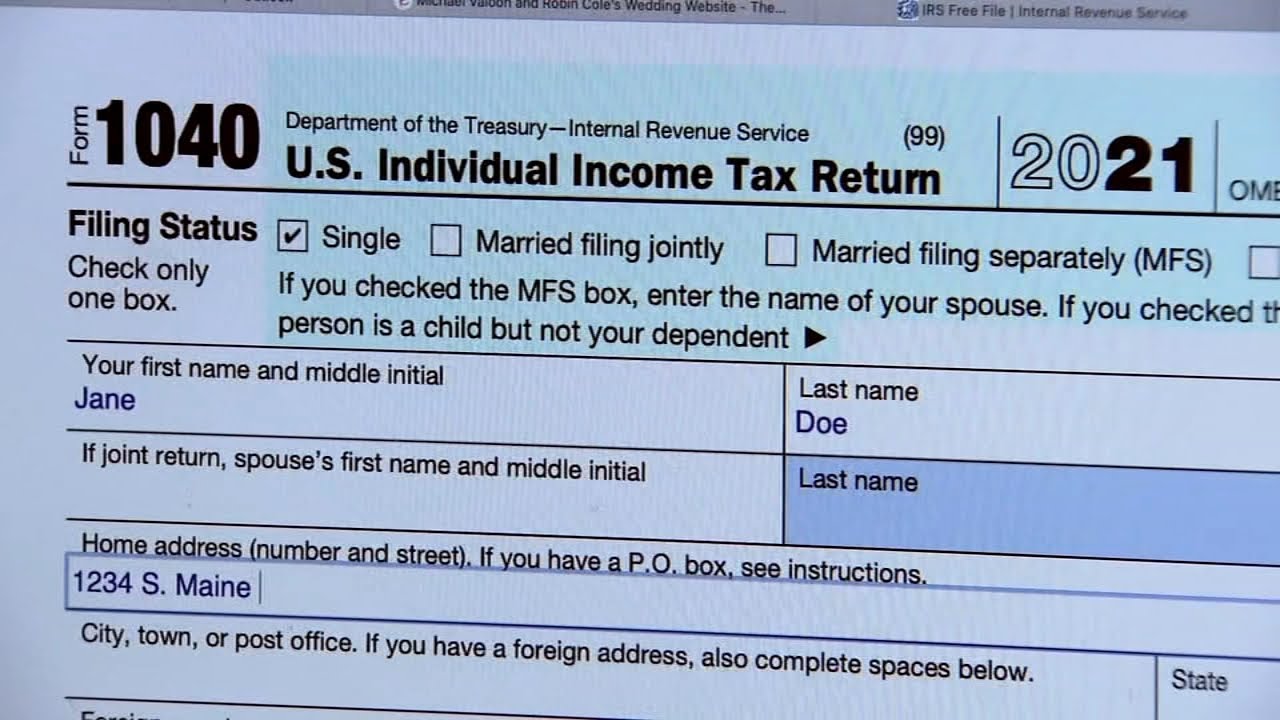

- The IRS relies on your most recent tax return to determine eligibility and calculate payment amounts.

Who Qualifies for the Stimulus Check?

The eligibility criteria for the $1,400 stimulus check hinge on several factors, including income level, filing status, and dependent status. Below is a detailed breakdown of the key qualifications used by the IRS to assess eligibility:

Individuals earning up to $75,000 annually and married couples earning up to $150,000 jointly qualify for the full payment. Payments gradually diminish for those earning above these thresholds until they are entirely phased out at $80,000 for individuals and $160,000 for couples.

Income Limits for Eligibility

- Single filers: Up to $75,000 (phased out at $80,000)

- Heads of household: Up to $112,500 (phased out at $120,000)

- Married couples filing jointly: Up to $150,000 (phased out at $160,000)

How to Track Your Stimulus Check

Verifying the status of your stimulus check is a straightforward process using the IRS's "Get My Payment" tool. This online platform allows you to monitor your payment progress by entering your Social Security number, date of birth, and other relevant filing details.

It is crucial to ensure that the information you provide matches your most recent tax return. If you haven't filed your taxes for the previous year, the IRS will refer to your 2019 return to determine eligibility.

Read also:Exploring The Thrilling World Of Tarkir Dragonstorm Spoilers

Steps to Use the "Get My Payment" Tool

- Access the IRS website and navigate to the "Get My Payment" tool.

- Input your Social Security number, date of birth, and filing status.

- Review the payment status displayed on the screen.

Dependent Eligibility and Payment Details

A notable update in the third round of stimulus checks is the inclusion of adult dependents in the payment structure. Previously, only dependents under the age of 17 qualified for payments. Now, adult dependents, including college students and disabled individuals, are eligible for the $1,400 payment.

Parents or guardians claiming dependents on their tax returns will receive an additional $1,400 for each dependent. This change significantly boosts the potential payment for families with multiple dependents.

Eligible Dependents

- Children under 17 years old

- College students and adult dependents

- Disabled individuals claimed as dependents

How Your Tax Return Affects Eligibility

Your tax return plays a pivotal role in determining your eligibility for the stimulus check. The IRS uses your most recent tax return to calculate your payment amount and confirm your income. If you have yet to file your taxes for the previous year, the IRS will consult your 2019 return for reference.

It is vital to ensure your tax information is accurate and up-to-date. Any discrepancies in your tax return could lead to delays or prevent your payment from being issued.

Tips for Filing Your Tax Return

- Submit your taxes promptly to ensure the IRS has the latest information.

- Double-check your income and dependent details to avoid errors.

- Provide the IRS with your direct deposit details to expedite payment receipt.

Steps to Take If You Haven't Received Your Payment

If you haven't received your stimulus check, there are several actions you can take to address the issue. Start by verifying your eligibility through the IRS's "Get My Payment" tool. If the tool confirms that your payment has been issued but you haven't received it, contact your bank to check the deposit status.

If the problem persists, you may need to file a claim with the IRS. This involves submitting a Recovery Rebate Credit form with your tax return to claim the missing payment.

Steps to Claim a Missing Payment

- Use the "Get My Payment" tool to verify your payment status.

- Contact your bank to confirm the deposit status.

- File a Recovery Rebate Credit form with your tax return if necessary.

Answers to Common Questions About the Stimulus Check

Here are responses to some frequently asked questions regarding the $1,400 stimulus check:

- Can I receive a stimulus check if I didn't file taxes? Yes, but you must file a tax return to claim the payment.

- What happens if my income has changed since my last tax return? The IRS will use your most recent tax return to determine eligibility.

- Will I need to pay taxes on the stimulus check? No, the stimulus check is not considered taxable income.

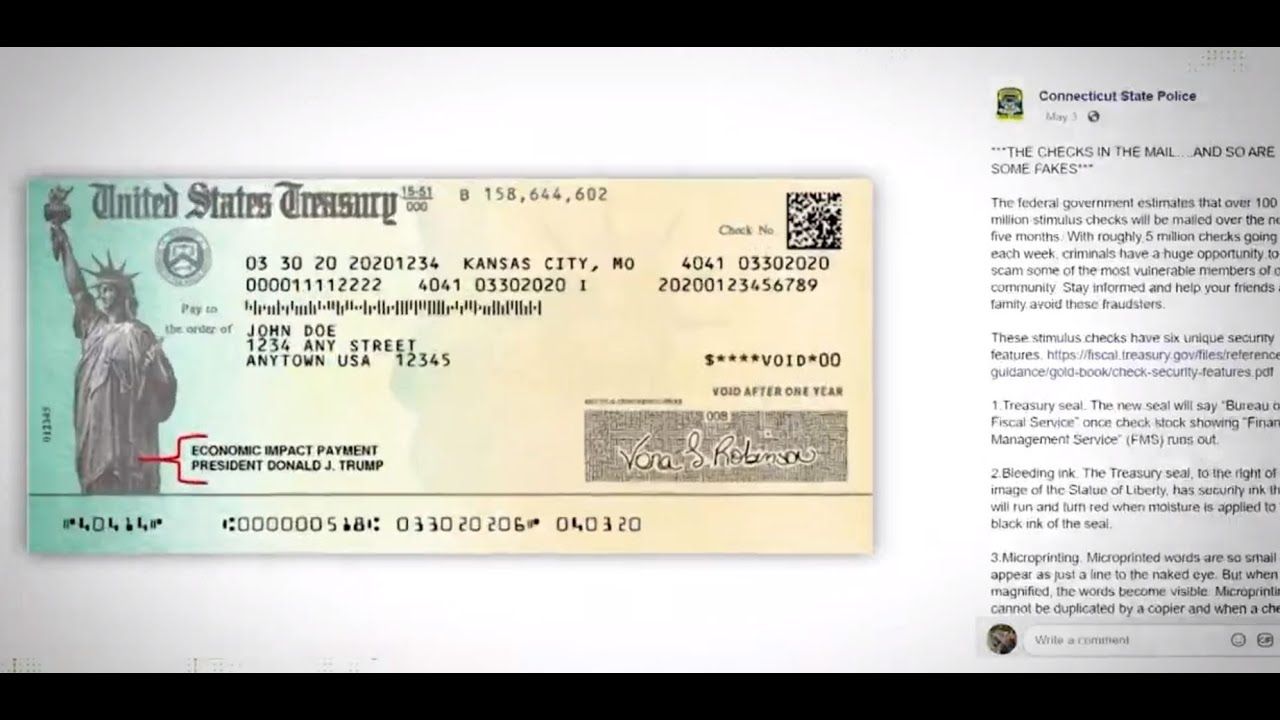

Protect Yourself from Stimulus Check Scams

With the distribution of stimulus checks, there has been a rise in scams targeting individuals. Scammers may attempt to steal your personal information or money by pretending to be the IRS or other government entities. To safeguard yourself, follow these precautions:

- Never disclose your Social Security number or bank account details to unsolicited callers or emails.

- Only utilize official IRS channels to check your payment status or file a claim.

- Beware of offers promising expedited payments for a fee.

Will There Be Additional Stimulus Payments?

Currently, there are no official announcements regarding further stimulus payments. However, the situation remains dynamic, and future payments may be considered based on economic conditions. Stay informed by keeping an eye on updates from the IRS and government officials.

If additional payments are authorized, they will likely follow a similar framework to previous rounds, with eligibility based on income and tax return data.

Conclusion and Next Steps

The $1,400 stimulus check serves as a critical financial lifeline for millions of Americans grappling with the economic fallout of the pandemic. By understanding the eligibility criteria and methods to verify your status, you can ensure you receive the payment you're entitled to.

We urge you to take the necessary steps by confirming your eligibility, checking your payment status, and filing any required claims. If you found this article informative, please share it with others who may benefit from the insights. Additionally, explore our other resources for further guidance on financial matters.

For more information, visit the official IRS website or consult a tax professional to maximize your access to available resources.