Alphabet Inc., the parent company of Google, continues to capture the attention of investors, analysts, and tech enthusiasts worldwide. As one of the largest and most influential companies in the global market, its stock price has become a critical focus for anyone interested in the financial landscape. Whether you're an experienced investor or new to the stock market, understanding the nuances of Alphabet's stock performance is essential for making well-informed decisions.

The stock price of Alphabet Inc. not only reflects the financial health of the company but also acts as a barometer for the broader technology sector. With its dominance in digital advertising, cloud computing, artificial intelligence, and other innovative fields, Alphabet plays a pivotal role in shaping the global economy. Analyzing stock price trends and understanding the factors influencing them can provide invaluable insights into the company's future potential.

In this article, we will explore the complexities of Alphabet's stock price, delving into historical data, market performance, and the various elements that contribute to its fluctuations. By the end, you will have a deeper understanding of how to evaluate and invest in this tech giant effectively.

Read also:Chief Justice John Roberts A Pillar Of American Jurisprudence

Table of Contents

- Introduction to Alphabet's Stock Price

- Historical Performance of Alphabet's Stock

- Factors Affecting Alphabet's Stock Price

- Key Financial Metrics

- Investment Strategies for Alphabet's Stock

- Long-Term Growth Potential

- Risks Associated with Alphabet's Stock

- Comparison with Competitors

- Future Outlook and Predictions

- Conclusion and Final Thoughts

Introduction to Alphabet's Stock Price

Alphabet's stock price has consistently been a key focus for investors seeking growth opportunities in the tech sector. Since its initial public offering (IPO) in 2004, the company has experienced remarkable growth, evolving into a multi-faceted conglomerate. Understanding the stock price requires more than just tracking daily fluctuations. It involves analyzing the company's financial health, market trends, and external factors that impact its valuation.

Investors must also consider the broader economic environment, regulatory changes, and technological advancements that could influence Alphabet's performance. By examining these elements, you can gain a deeper understanding of the company's stock price and its potential for future growth.

Why Alphabet's Stock Matters

Alphabet's stock matters because it represents one of the most valuable companies globally. Its influence extends beyond the stock market, impacting industries such as advertising, cloud services, and artificial intelligence. By investing in Alphabet, shareholders gain exposure to a diverse range of revenue streams and cutting-edge innovations, making it a compelling choice for those seeking long-term growth.

Historical Performance of Alphabet's Stock

Alphabet's stock price journey began with its IPO in August 2004, where shares were priced at $85 each. Since then, the stock has seen exponential growth, undergoing multiple splits to accommodate its rising value. By examining historical data, we can identify key milestones and trends that have shaped its performance.

Major Milestones

- 2004: Alphabet's IPO marked the beginning of its public trading journey.

- 2014: The stock split 2-for-1, introducing a new class of non-voting shares.

- 2023: Another stock split occurred, making shares more accessible to retail investors.

Factors Affecting Alphabet's Stock Price

Several factors influence Alphabet's stock price, including economic conditions, company performance, and industry trends. These elements interact to create a dynamic environment that impacts valuation. Understanding these factors is crucial for investors looking to make informed decisions.

External Economic Factors

Economic indicators such as inflation rates, interest rates, and global trade policies can significantly affect Alphabet's stock price. For instance, rising interest rates may lead to increased borrowing costs, impacting the company's financial operations. Additionally, global economic conditions can influence consumer spending, which directly affects Alphabet's revenue streams.

Read also:Exploring The Distinct Charm Of Montana And Wisconsin

Internal Company Factors

Alphabet's financial results, product launches, and strategic decisions also play a crucial role in determining its stock price. Strong earnings reports, innovative product releases, and strategic partnerships can boost investor confidence and drive the stock upward. Conversely, unexpected setbacks or negative news can lead to volatility in the stock price.

Key Financial Metrics

When evaluating Alphabet's stock price, investors often rely on key financial metrics to gauge the company's performance. These metrics include revenue growth, earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE). Analyzing these metrics can provide valuable insights into the company's financial health and future prospects.

Revenue Growth

Alphabet's revenue has consistently grown over the years, driven by its dominant position in digital advertising. In 2022, the company reported over $280 billion in revenue, reflecting its robust business model. This growth is fueled by its diverse portfolio of products and services, including Google Search, YouTube, Google Cloud, and Android.

Investment Strategies for Alphabet's Stock

Investing in Alphabet's stock requires a well-thought-out strategy that aligns with your financial goals and risk tolerance. Whether you're a long-term investor or a day trader, understanding the stock's behavior is essential for success. Developing a clear strategy can help you navigate the complexities of the stock market and maximize your returns.

Long-Term Investment

For those seeking long-term gains, holding Alphabet's stock can be a lucrative strategy. The company's strong fundamentals, commitment to innovation, and diverse revenue streams make it an attractive option for buy-and-hold investors. By staying informed about market trends and company developments, you can make informed decisions that align with your long-term goals.

Long-Term Growth Potential

Alphabet's long-term growth potential is fueled by its expanding portfolio of products and services. From YouTube and Android to Google Cloud and AI research, the company continues to diversify its revenue streams, ensuring sustained growth in the future. By investing in emerging technologies and expanding into new markets, Alphabet is well-positioned to maintain its leadership in the tech industry.

Emerging Markets

Expanding into emerging markets presents significant opportunities for Alphabet. By leveraging its existing platforms and developing new solutions tailored to local needs, the company can further solidify its global presence. This expansion not only enhances its revenue potential but also strengthens its competitive position in the global market.

Risks Associated with Alphabet's Stock

While Alphabet's stock offers immense potential, it is not without risks. Regulatory challenges, data privacy concerns, and intense competition in the tech industry pose threats to its stock price. Understanding these risks is essential for investors looking to make informed decisions.

Regulatory Risks

As a dominant player in the digital advertising market, Alphabet faces scrutiny from regulators worldwide. Antitrust investigations and potential fines could impact its financial performance and stock valuation. Staying informed about regulatory developments is crucial for investors looking to mitigate these risks.

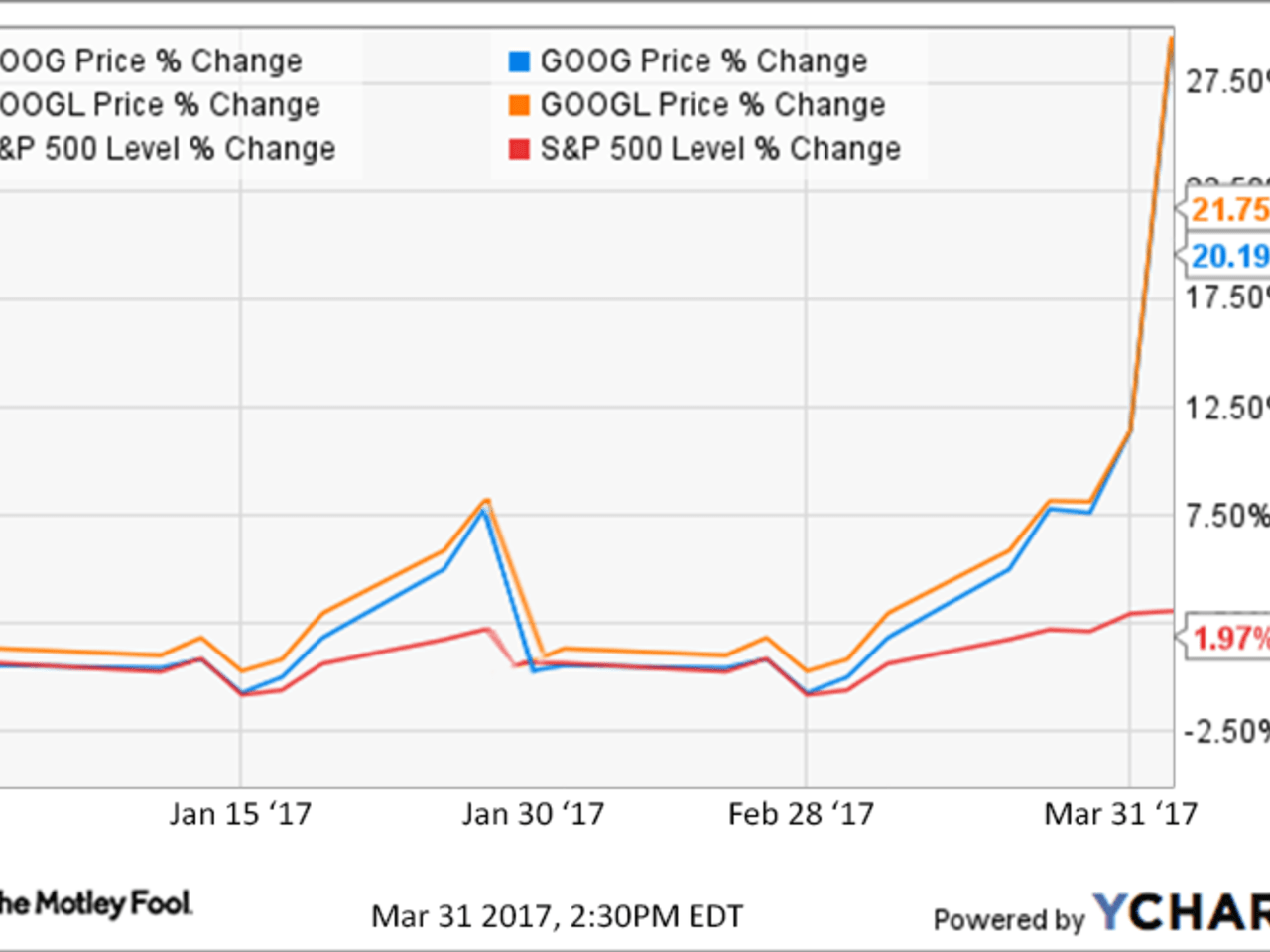

Comparison with Competitors

Alphabet competes with other tech giants such as Apple, Amazon, and Microsoft in various sectors. Comparing Alphabet's stock price with these competitors provides valuable insights into its relative strengths and weaknesses. In the digital advertising space, Alphabet holds a significant market share, surpassing competitors like Facebook and Twitter. However, in areas such as e-commerce, Amazon dominates, highlighting the importance of diversification.

Market Share Analysis

Analyzing market share data can provide valuable insights into Alphabet's competitive position. By comparing its performance with other tech giants, investors can better understand the company's strengths and weaknesses. This analysis can help inform investment decisions and identify potential opportunities for growth.

Future Outlook and Predictions

The future outlook for Alphabet's stock remains optimistic, driven by technological advancements and strategic initiatives. Analysts predict continued growth in areas such as AI, cloud computing, and autonomous vehicles. By staying at the forefront of innovation, Alphabet is well-positioned to capitalize on emerging trends and drive future growth.

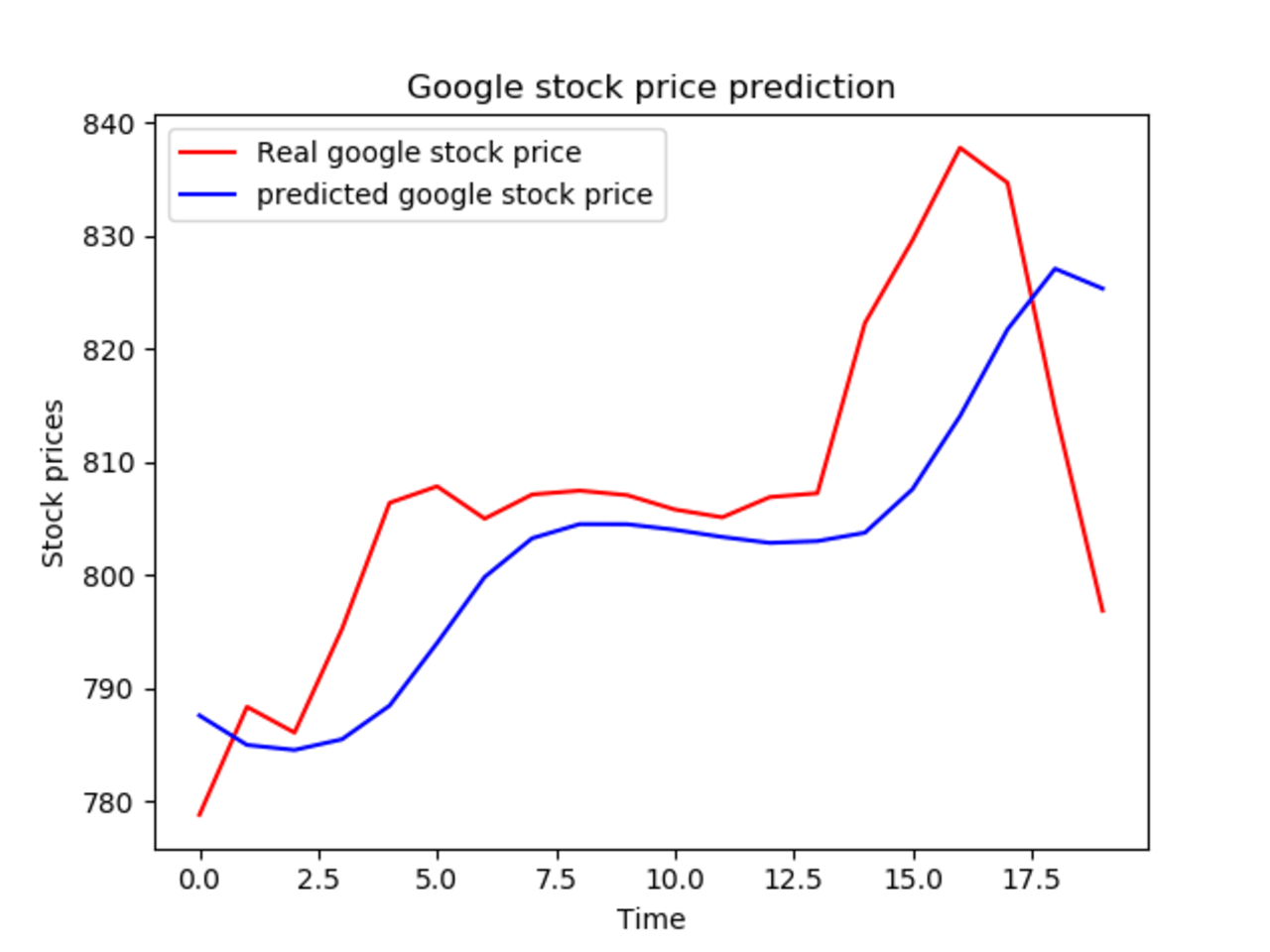

Predictive Modeling

Using predictive models, experts forecast that Alphabet's stock price could reach new heights in the coming years, contingent upon favorable market conditions and successful execution of its business strategies. Staying informed about these predictions can help investors make informed decisions and maximize their returns.

Conclusion and Final Thoughts

In conclusion, Alphabet's stock price represents a compelling investment opportunity for those seeking exposure to the tech sector. By understanding the factors influencing its performance and adopting a strategic approach, investors can capitalize on its long-term potential. We encourage readers to engage with this content by leaving comments, sharing their insights, and exploring other articles on our platform. Together, we can deepen our understanding of the financial markets and make informed decisions that align with our goals.