Investing in Google stock has emerged as one of the most attractive opportunities in the global financial market. As a tech giant based in Silicon Valley, Google continues to captivate investors worldwide with its impressive stock performance. Whether you're an experienced investor or new to the market, gaining insight into Google stock is essential for anyone interested in exploring its vast potential.

Google stock is more than just a financial asset—it serves as a testament to the innovation and leadership of one of the world’s premier technology companies. Since its initial public offering (IPO) in 2004, Alphabet Inc., Google's parent company, has consistently demonstrated robust financial performance, making its stock highly sought after by both retail and institutional investors alike.

This comprehensive guide will delve into the world of Google stock, examining its historical achievements, current market trends, and future prospects. By the end of this article, you will have a thorough understanding of why Google stock is a key player in the stock market and how it could influence your investment portfolio.

Read also:The Epic Islanders Vs Penguins Rivalry A Deep Dive Into One Of Hockeys Greatest Battles

Table of Contents

- The Evolution of Google Stock

- Google's Groundbreaking Initial Public Offering (IPO)

- Analyzing Google Stock Performance Over Time

- Google Stock in Today's Market

- Key Factors Influencing Google Stock Price

- Sub-Factors Shaping Stock Performance

- Dividends and Stock Splits: How They Impact Investors

- The Bright Future of Google Stock

- Potential Risks of Investing in Google Stock

- Conclusion and Next Steps

The Evolution of Google Stock

Google stock boasts a fascinating history that traces back to the company's foundation. Established by Larry Page and Sergey Brin in 1998, Google rapidly gained prominence with its groundbreaking search engine technology. The company's journey toward becoming a publicly traded entity began in 2004 when it decided to go public through an initial public offering (IPO).

This decision to go public was motivated by the need to secure capital for expansion and further innovation. Google's IPO stood out due to its unconventional approach, utilizing an auction system for share allocation rather than the traditional underwriting process. This method garnered substantial media attention and laid the groundwork for its enduring success in the stock market.

Since its IPO, Google stock has undergone significant transformations, including the reorganization into Alphabet Inc. in 2015. This restructuring was designed to streamline operations and enhance transparency for investors, reinforcing its status as a leading tech stock.

Google's Groundbreaking Initial Public Offering (IPO)

Google's IPO in 2004 marked a pivotal moment in the tech industry. The company offered its shares at $85 each, raising approximately $1.9 billion in the process. This IPO not only provided Google with the necessary capital for expansion but also introduced its stock to a global audience of investors.

A standout feature of Google's IPO was its innovative approach to share allocation. Rather than relying on traditional underwriters, Google adopted an auction system, allowing individual investors to bid for shares. This strategy aimed to democratize the IPO process and ensure equitable access for all investors.

Key Highlights of Google's IPO

- Price per share: $85

- Total funds raised: $1.9 billion

- Unique auction system for share allocation

- Strong demand from both institutional and retail investors

The success of Google's IPO set the stage for its future performance in the stock market, establishing it as a dominant force in the tech industry.

Read also:Exploring The Flames Vs Rangers Rivalry In Nhl Hockey

Analyzing Google Stock Performance Over Time

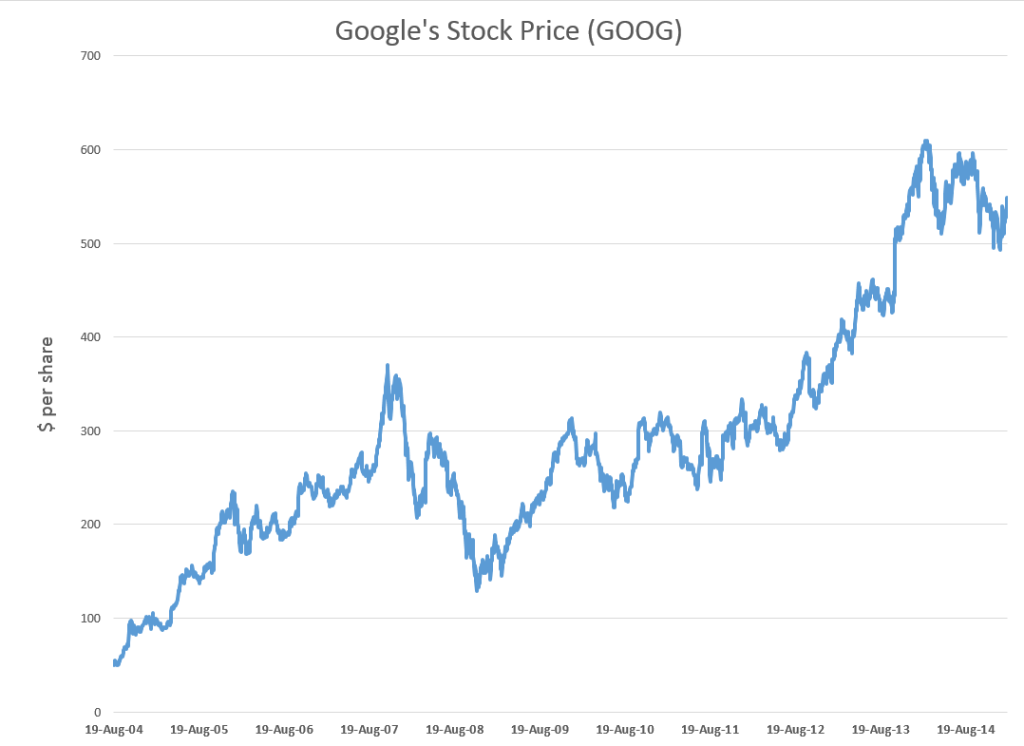

Since its IPO, Google stock has experienced remarkable growth, reflecting the company's leadership in the digital advertising market and its commitment to innovation across various sectors. The stock price has consistently increased over the years, cementing its reputation as one of the top-performing tech stocks.

Financial data reveals that Google stock has consistently outperformed major market indices, such as the S&P 500. This exceptional performance can be attributed to the company's robust financial health, strategic acquisitions, and investments in emerging technologies like artificial intelligence and cloud computing.

Key Milestones in Google Stock Performance

- 2007: Google stock surpassed $700 per share for the first time.

- 2015: The reorganization into Alphabet Inc. led to a significant surge in stock price.

- 2020: Google stock reached record highs during the global pandemic, driven by increased demand for digital advertising.

These milestones underscore the resilience and growth potential of Google stock, making it an appealing option for long-term investors.

Google Stock in Today's Market

As of the latest market trends, Google stock remains a cornerstone of the tech sector. The company's robust financial performance, coupled with its dominance in digital advertising, has fueled its consistent rise in the stock market.

In 2023, Google stock is trading at an all-time high, reflecting investor confidence in its future prospects. The company's focus on cutting-edge technologies, such as artificial intelligence and quantum computing, further solidifies its position as a leader in the tech industry.

According to data from leading financial institutions, Google stock is poised to maintain its upward trajectory, driven by its innovative business model and strategic investments. This outlook makes it an enticing option for investors seeking to benefit from the growth of the tech sector.

Key Factors Influencing Google Stock Price

The price of Google stock is influenced by a wide range of factors, both internal and external. Understanding these factors is vital for investors aiming to make well-informed decisions about their investments.

Internal Factors

Internal factors encompass the company's financial performance, strategic decisions, and product innovations. Google's impressive revenue growth, primarily driven by its digital advertising business, has been a major driver of its stock price. Furthermore, the company's investments in emerging technologies, such as artificial intelligence and cloud computing, have enhanced its long-term growth prospects.

External Factors

External factors include market conditions, regulatory changes, and global economic trends. The performance of the broader tech sector and investor sentiment can significantly affect Google stock. Regulatory challenges, such as antitrust investigations, also play a role in shaping the company's future outlook.

Sub-Factors Shaping Stock Performance

1. Digital Advertising Revenue

Google's digital advertising business constitutes a substantial portion of its revenue. Shifts in consumer behavior and advertising trends can directly impact its stock performance. For instance, the transition to mobile advertising has been a significant growth driver for Google in recent years.

2. Cloud Computing Expansion

Google's foray into cloud computing represents a promising avenue for growth. The company's investments in infrastructure and collaborations with enterprises have positioned it as a formidable competitor in this market. This expansion is expected to contribute significantly to its future revenue streams.

3. Regulatory Challenges

Regulatory scrutiny, particularly in data privacy and antitrust, poses potential risks to Google stock. The company's ability to address these challenges will be crucial in preserving its market position and stock performance.

Dividends and Stock Splits: How They Impact Investors

Google stock has experienced several stock splits over the years, affecting its price and accessibility for investors. Although the company does not currently distribute dividends, its focus on share buybacks and stock splits serves as a key strategy for rewarding shareholders.

In 2022, Alphabet Inc. announced a 20-for-1 stock split, making its shares more affordable for retail investors. This move aimed to enhance liquidity and broaden the investor base. While dividends may not be a priority for Google, its dedication to shareholder value through alternative means remains unwavering.

The Bright Future of Google Stock

The future of Google stock appears promising, fueled by its ongoing innovation and expansion into new markets. The company's emphasis on artificial intelligence, cloud computing, and emerging technologies positions it favorably for long-term growth. Additionally, its strong financial foundation and strategic investments provide a solid base for future success.

Analysts forecast that Google stock will continue to outperform the market, driven by its leadership in digital advertising and its growing presence in cloud services. The company's commitment to sustainability and ethical business practices further enhances its appeal to socially conscious investors.

For investors aiming to capitalize on the growth of the tech sector, Google stock remains a compelling choice with significant potential for appreciation.

Potential Risks of Investing in Google Stock

While Google stock offers substantial growth potential, it is not without risks. Investors should be mindful of the challenges and uncertainties that could impact its performance.

Regulatory scrutiny, particularly in data privacy and antitrust, poses a potential risk to Google's operations. Furthermore, competition in the tech sector is fierce, with companies like Amazon and Microsoft striving for market share in cloud computing and other emerging technologies.

Global economic trends, such as inflation and interest rate fluctuations, can also influence Google stock. Investors should carefully assess these factors when making investment decisions.

Conclusion and Next Steps

Google stock presents a unique opportunity for investors seeking to benefit from the growth of the tech sector. Its robust financial performance, innovative business model, and commitment to emerging technologies make it an attractive choice for both short-term and long-term investments.

As discussed in this article, Google stock has a storied history of success, driven by its dominance in digital advertising and its expansion into new markets. While risks exist, the company's strong leadership and strategic focus position it well for future growth.

We encourage you to share your thoughts and experiences with Google stock in the comments section below. Additionally, feel free to explore other articles on our site for further insights into the world of investing. Thank you for reading, and we wish you success in your investment journey!