Navigating student loan management can feel overwhelming, particularly when it comes to the recertification process for Income-Driven Repayment (IDR) plans. Many borrowers find themselves puzzled about the steps involved and how to proceed when applications are temporarily unavailable. If you're among the millions of borrowers dealing with this challenge, understanding your options is key to maintaining financial stability and ensuring compliance with your repayment plan.

Effectively managing student loans goes beyond simply making monthly payments. It involves gaining a deep understanding of the various repayment plans available and how they can impact your financial future. IDR plans are specifically designed to make repayment more manageable by aligning monthly payments with your income and family size. The recertification process plays a crucial role in ensuring that these payments remain both accurate and affordable, adapting to your evolving financial situation.

When IDR applications are temporarily closed, borrowers have several strategies to manage their loans and prevent falling behind. This guide will provide a detailed walkthrough of the process, offering valuable insights and actionable advice to help you navigate this complex situation. Let’s explore the options and strategies available to you!

Read also:Dairy Queen A Delightful Treat For Every Occasion

Table of Contents

Understanding Income-Driven Repayment (IDR)

The Importance of the IDR Recertification Process

Managing Loans When Applications Are Closed

Short-Term Solutions for Borrowers

Long-Term Strategies for Loan Management

Read also:Discover The Vibrant City Of Tallahassee A Guide To Floridas Capital

Addressing Common Questions About IDR Recertification

The Financial Ramifications of Delayed Recertification

Tips for a Successful IDR Recertification

Valuable Resources for Further Assistance

Understanding Income-Driven Repayment (IDR)

Income-Driven Repayment (IDR) is a federal student loan repayment plan tailored to make monthly payments more manageable for borrowers by aligning them with their income and family size. Unlike traditional repayment plans that require fixed payments over a set period, IDR plans adjust payments annually to reflect changes in a borrower's financial circumstances. This flexibility ensures that payments remain affordable even as income fluctuates.

There are several types of IDR plans available, each with its own eligibility criteria and benefits:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Regardless of the specific plan chosen, all IDR options aim to reduce the financial burden on borrowers by capping monthly payments at a percentage of their discretionary income. This ensures that repayment remains feasible even during periods of financial uncertainty.

Eligibility for IDR Plans

To qualify for an IDR plan, borrowers must meet specific criteria, including having eligible federal student loans and demonstrating a partial financial hardship. Eligible loans typically include Direct Loans, Federal Family Education Loans (FFEL), and certain consolidation loans. Demonstrating financial hardship involves proving that the standard repayment plan would result in payments that exceed a certain percentage of your discretionary income. Understanding these requirements is essential for determining whether you qualify for an IDR plan.

The Importance of the IDR Recertification Process

The IDR recertification process is an annual requirement for borrowers enrolled in these plans. During recertification, borrowers must update their income and family size information to ensure that their monthly payments remain accurate and affordable. This process typically involves submitting updated tax returns or income documentation to their loan servicer, ensuring that the payment structure continues to align with their current financial situation.

Steps for Recertification

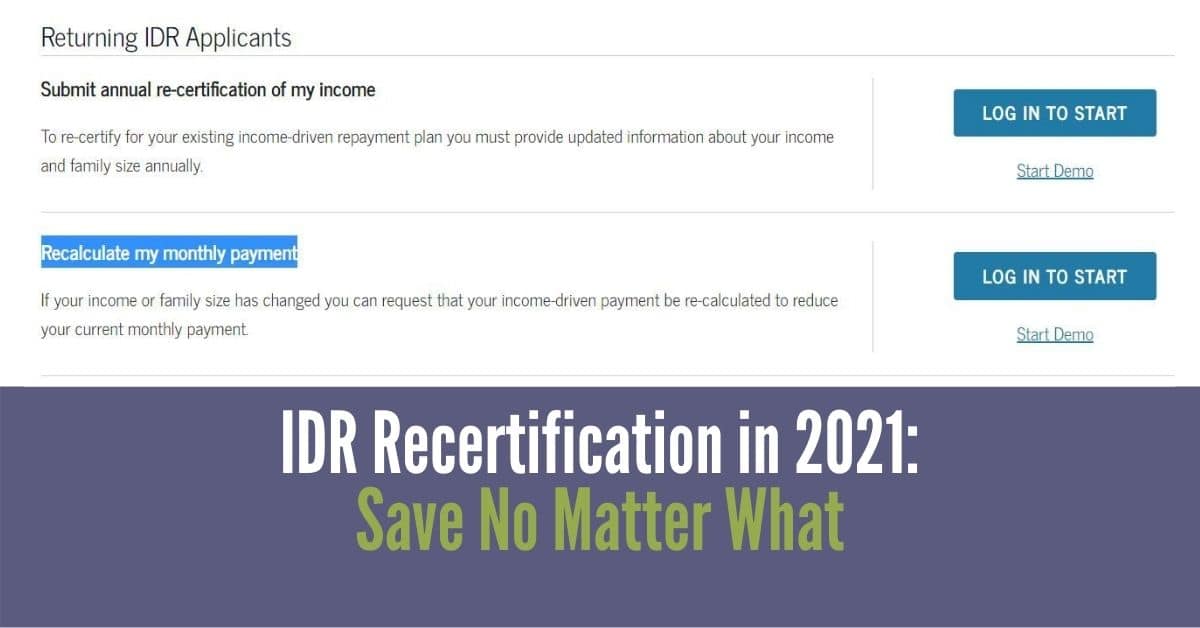

Recertifying your IDR plan involves a straightforward process that can be broken down into the following steps:

- Gather all necessary documents, such as tax returns, W-2 forms, or recent pay stubs, to provide accurate income verification.

- Complete the recertification form provided by your loan servicer, ensuring that all information is accurate and up-to-date.

- Submit the completed form and supporting documents by the specified deadline to avoid any disruption in your repayment plan.

- Regularly monitor your account for updates and confirm that your recertification has been successfully processed by your servicer.

Managing Loans When Applications Are Closed

When IDR applications are temporarily closed, borrowers may face uncertainty about how to proceed with their recertification. However, there are several options available to help manage loans during this period:

- Forbearance: Request a temporary suspension of payments through forbearance, which can provide short-term relief while IDR applications are unavailable.

- Deferment: If eligible, apply for deferment to pause payments without accruing interest during the closure period.

- Alternative Repayment Plans: Consider switching to a different repayment plan, such as the Extended Repayment Plan, until IDR applications reopen, ensuring that payments remain manageable.

Impact of Forbearance and Deferment

While forbearance and deferment can provide temporary relief, it's important to understand the potential long-term effects on your loan balance. Interest may continue to accrue during these periods, which could increase the total amount owed over time. Carefully weigh the benefits and drawbacks of these options before proceeding to avoid unexpected financial burdens.

Short-Term Solutions for Borrowers

For borrowers facing immediate financial challenges, there are several short-term solutions to consider:

- Communicate with Your Loan Servicer: Reach out to your loan servicer to discuss available options and request assistance tailored to your specific situation.

- Temporary Payment Adjustments: Some servicers may offer temporary reductions or adjustments to your monthly payments to help you stay current during difficult times.

- Explore Loan Consolidation: Consolidating your loans into a single Direct Consolidation Loan can simplify repayment and provide access to additional repayment plans, offering greater flexibility.

Long-Term Strategies for Loan Management

While short-term solutions can provide immediate relief, developing a long-term plan for managing your student loans is essential. Consider the following strategies to ensure financial stability over time:

- Track Your Progress: Regularly monitor your loan balance, interest rates, and repayment progress to ensure you're on track for loan forgiveness or payoff, maintaining a clear understanding of your financial journey.

- Explore Refinancing Options: If eligible, refinancing your loans through a private lender may offer lower interest rates and reduced monthly payments, significantly impacting your overall financial burden.

- Plan for Future Recertifications: Stay organized and prepare for future recertifications by keeping accurate records of any changes in your income and family size, ensuring a seamless process each year.

Maximizing Loan Forgiveness Opportunities

Borrowers enrolled in IDR plans may qualify for loan forgiveness after making qualifying payments for 20-25 years, depending on the specific plan. Understanding the requirements for forgiveness and maintaining meticulous records of your payments can help ensure you meet all necessary criteria, paving the way for financial relief.

Addressing Common Questions About IDR Recertification

Here are some frequently asked questions about the IDR recertification process:

- What happens if I miss the recertification deadline? Missing the deadline may result in higher payments or a loss of eligibility for the IDR plan. Contact your loan servicer immediately to explore available options and address the situation promptly.

- Can I change my IDR plan? Yes, borrowers have the flexibility to switch between IDR plans at any time by contacting their loan servicer, allowing for adjustments based on changing financial circumstances.

- Will my payments increase if my income goes up? Yes, IDR payments are directly tied to income, so an increase in income will likely result in higher monthly payments, reflecting your updated financial situation.

The Financial Ramifications of Delayed Recertification

Delays in IDR recertification can have significant financial consequences for borrowers. Failure to recertify on time may lead to increased monthly payments, penalties, or even default if payments are missed. It's crucial to prioritize recertification and seek assistance if needed to avoid these negative outcomes.

Minimizing Financial Risks

To minimize financial risks, borrowers should:

- Set reminders for recertification deadlines to ensure timely submission of all required documentation.

- Stay informed about updates or changes to IDR policies, keeping abreast of any modifications that could impact your repayment plan.

- Build an emergency fund to cover unexpected financial challenges, providing a safety net during periods of financial uncertainty.

Tips for a Successful IDR Recertification

Here are some tips to ensure a smooth and successful IDR recertification process:

- Submit all required documentation promptly and accurately, verifying that all information is up-to-date and complete.

- Verify that your loan servicer has received and processed your recertification, following up as needed to ensure the process is completed without delay.

- Stay proactive by addressing any issues or questions with your servicer as soon as possible, preventing potential complications from arising.

Importance of Organization

Maintaining detailed records of your income, family size, and communication with your loan servicer is essential for a successful recertification. Organize your documents in a secure and easily accessible location, updating them regularly to avoid delays or errors that could disrupt your repayment plan.

Valuable Resources for Further Assistance

For additional support and guidance, consider the following resources:

- Federal Student Aid – A comprehensive resource for student loan information and assistance, offering detailed guidance on all aspects of loan management.

- Consumer Financial Protection Bureau – Provides guidance and resources for borrowers navigating student loan challenges, ensuring access to reliable information and support.

- Student Loan Borrower Assistance – Offers free information and advice for student loan borrowers, helping to demystify the complexities of loan repayment and management.

Conclusion

Navigating the IDR recertification process can be challenging, especially when applications are temporarily closed. However, by understanding your options, staying informed, and taking proactive steps, you can successfully manage your student loans and avoid potential financial pitfalls. Prioritizing communication with your loan servicer, maintaining accurate records, and exploring available resources for assistance are key to achieving financial stability and peace of mind.

We encourage you to share this article with fellow borrowers and leave a comment below if you have any questions or insights to add. For more information on student loan management, explore our other articles and resources. Together, we can work toward a financially secure future!