The Federal Reserve's interest rate, commonly referred to as the federal funds rate, plays a crucial role in shaping the economic landscape of the United States and the world. It serves as a powerful tool for controlling inflation, managing economic growth, and stabilizing financial markets. As the central bank of the United States, the Federal Reserve's decisions regarding the federal funds rate have far-reaching implications, affecting everything from mortgage rates to international trade balances.

Grasping the intricacies of the federal funds rate is essential for anyone aiming to make informed financial decisions. Whether you are a business owner, an investor, or someone managing personal finances, staying updated with the Federal Reserve's monetary policies can help you anticipate economic changes and plan effectively.

This article will explore the federal funds rate in depth, examining its mechanisms and its impact on various sectors. By the end, you will have a thorough understanding of how the federal funds rate influences both your financial well-being and the broader economy.

Read also:Yella Beezy A Comprehensive Overview

Table of Contents

- Introduction to the Federal Funds Rate

- A Brief History of the Federal Funds Rate

- How the Federal Funds Rate Works

- Factors Influencing the Federal Funds Rate

- The Impact of the Federal Funds Rate on the Economy

- Federal Funds Rate and Its Influence on Investors

- How the Federal Funds Rate Affects Consumers

- Global Implications of Changes in the Federal Funds Rate

- Predicting Future Movements of the Federal Funds Rate

- Conclusion

Introduction to the Federal Funds Rate

What is the Federal Funds Rate?

The federal funds rate, officially known as the federal funds rate, is the interest rate at which banks lend reserve balances to other banks on an overnight basis. This rate is established by the Federal Open Market Committee (FOMC), the monetary policymaking body of the Federal Reserve System. The federal funds rate serves as a benchmark for other interest rates, influencing everything from credit card rates to mortgage loans, and plays a pivotal role in shaping the financial ecosystem.

Why is the Federal Funds Rate Important?

The significance of the federal funds rate cannot be overstated. It acts as a lever to control inflation and maintain economic stability. By adjusting the federal funds rate, the Federal Reserve can either stimulate economic growth during downturns or cool down an overheating economy. This delicate balancing act is essential for fostering a healthy and stable economic environment.

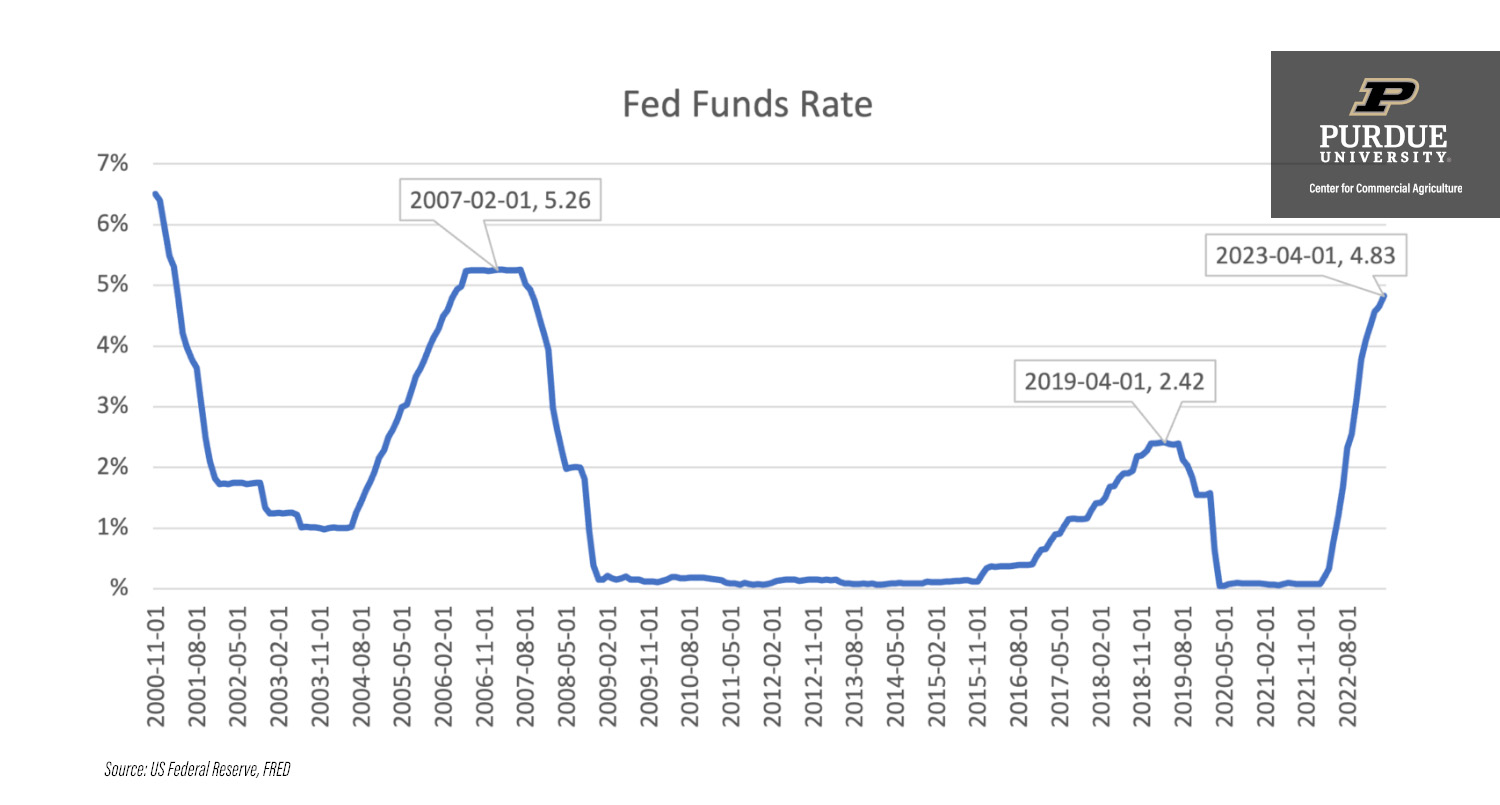

A Brief History of the Federal Funds Rate

Since its establishment in 1913, the Federal Reserve has utilized the federal funds rate as a tool to manage economic conditions. Over the decades, the federal funds rate has experienced significant fluctuations, reflecting the economic realities of each era. For instance, during the 1980s, the federal funds rate reached unprecedented heights to combat high inflation, while in the aftermath of the 2008 financial crisis, it was reduced to near-zero levels to spur economic recovery. This historical context underscores the adaptability of the federal funds rate in addressing diverse economic challenges.

How the Federal Funds Rate Works

Setting the Federal Funds Rate

The process of setting the federal funds rate involves regular meetings of the FOMC, where members meticulously analyze economic data and forecasts to determine the appropriate level for the rate. The committee takes into account a wide range of factors, such as inflation, unemployment, and economic growth, to make informed decisions that align with the broader goals of monetary policy.

Implementation of the Federal Funds Rate

Once the federal funds rate is established, it is implemented through open market operations, where the Federal Reserve buys or sells government securities to influence the money supply. This mechanism ensures that the actual overnight lending rate aligns closely with the target federal funds rate, thereby maintaining the intended economic impact.

Factors Influencing the Federal Funds Rate

- Inflation: High inflation often prompts the Federal Reserve to raise the federal funds rate to reduce spending and borrowing, ensuring price stability.

- Economic Growth: Strong economic growth may lead to higher federal funds rates to prevent overheating and maintain sustainable development.

- Unemployment: High unemployment can result in lower federal funds rates to encourage job creation and stimulate economic activity.

- Global Economic Conditions: The Federal Reserve also considers international economic factors when setting the federal funds rate, recognizing the interconnected nature of global economies.

The Impact of the Federal Funds Rate on the Economy

Effects on Businesses

Changes in the federal funds rate can have profound effects on businesses. Higher rates increase borrowing costs, potentially reducing investment and expansion plans, while lower rates can stimulate business activity by making credit more accessible. This dynamic relationship between the federal funds rate and business operations highlights its critical role in shaping the economic landscape.

Read also:Purdue Basketball A Legacy Of Excellence And Passion

Effects on Employment

The federal funds rate also plays a significant role in influencing employment levels. By adjusting the rate, the Federal Reserve aims to achieve maximum employment without triggering inflation. This delicate balance is crucial for maintaining a stable labor market and fostering economic growth.

Federal Funds Rate and Its Influence on Investors

Stock Market Reactions

Investors closely monitor federal funds rate decisions, as they can have immediate and significant effects on the stock market. Generally, lower rates are viewed positively for stocks, as they encourage borrowing and investment. However, prolonged low rates can raise concerns about economic stagnation, highlighting the complex interplay between monetary policy and market dynamics.

Bond Market Dynamics

The bond market is particularly sensitive to changes in the federal funds rate. Rising rates typically lead to falling bond prices, as existing bonds with lower yields become less attractive compared to newly issued bonds with higher yields. This relationship underscores the importance of understanding the federal funds rate's impact on fixed-income investments.

How the Federal Funds Rate Affects Consumers

Impact on Borrowing

Consumers experience the effects of the federal funds rate through changes in borrowing costs. Adjustable-rate mortgages, car loans, and credit card interest rates are all influenced by the federal funds rate. Understanding these dynamics can empower consumers to make better financial decisions, optimizing their borrowing and saving strategies.

Savings and Investments

Higher federal funds rates can be advantageous for savers, as they often lead to higher returns on savings accounts and certificates of deposit. However, for those with debt, higher rates can increase the cost of servicing that debt, highlighting the dual-edged impact of monetary policy on personal finances.

Global Implications of Changes in the Federal Funds Rate

The federal funds rate has global implications due to the dominance of the U.S. dollar in international trade and finance. Changes in the rate can affect currency exchange rates, capital flows, and economic policies of other countries. For example, a higher federal funds rate can attract foreign capital to the U.S., strengthening the dollar but potentially harming export competitiveness. This interconnectedness underscores the global significance of the Federal Reserve's monetary policy decisions.

Predicting Future Movements of the Federal Funds Rate

Current Economic Indicators

To predict future movements of the federal funds rate, analysts examine a range of economic indicators, including employment data, inflation reports, and GDP growth figures. By understanding these indicators, one can gain valuable insights into the Federal Reserve's likely actions, enabling better preparation for potential economic shifts.

Long-Term Trends

Looking ahead, the Federal Reserve's approach to the federal funds rate will likely be shaped by long-term trends such as technological advancements, demographic shifts, and global economic integration. These factors will continue to influence monetary policy decisions, highlighting the evolving nature of economic management in a rapidly changing world.

Conclusion

In conclusion, the federal funds rate is a cornerstone of the Federal Reserve's monetary policy toolkit. It impacts a wide array of economic activities, from business investments to consumer borrowing. By understanding the mechanisms and implications of the federal funds rate, individuals and organizations can better navigate the complexities of the modern economy, making informed decisions that align with their financial goals.

We encourage you to share your thoughts and questions in the comments section below. Additionally, explore other articles on our site to deepen your understanding of financial topics. Stay informed and empowered in your financial journey!

Data Source: Federal Reserve, Bureau of Labor Statistics, and International Monetary Fund.