As the global pandemic continues to impact millions of lives, the IRS has issued a final call for individuals to claim their pandemic-era stimulus checks. These financial aids were designed to offer relief during difficult economic times. If you've overlooked the opportunity or haven't claimed your checks yet, this guide will walk you through the necessary steps to secure your rightful benefits. Now is the time to act and ensure you receive the support you're entitled to.

The pandemic-era stimulus checks represent a vital financial resource for countless Americans who faced hardships during the health crisis. With the IRS urging individuals to take immediate action, it's essential to understand the process and timeline for claiming these funds. This article will provide an in-depth breakdown of eligibility criteria, the application process, and other crucial details to ensure no one misses out on their entitled benefits.

For those who have yet to claim their stimulus checks, swift action is necessary. The IRS has set a firm deadline for these claims, and missing it could mean losing access to much-needed financial assistance. By understanding the specifics of the program and adhering to the IRS's guidelines, you can safeguard your financial stability during uncertain times.

Read also:Boston Bruins Vs Vegas Golden Knights An Epic Nhl Rivalry

Content Overview

- Introduction

- Who Qualifies for Pandemic Stimulus Checks?

- IRS Guidelines for Claiming Stimulus Checks

- How to Claim Your Stimulus Check

- Important Timeline and Deadlines

- What to Do If You Missed Previous Stimulus Checks

- Common Issues and Solutions

- Tax Implications of Stimulus Checks

- Useful Resources for Further Assistance

- Conclusion and Next Steps

Introduction

The pandemic has reshaped economies worldwide, leaving millions of individuals and families struggling to manage their finances. In response, the U.S. government, through the IRS, introduced a series of stimulus checks aimed at providing financial relief to those in need. As the final deadline for claiming these checks approaches, it's more important than ever for eligible individuals to understand the process and act promptly.

These stimulus checks have been a lifeline for many, offering crucial financial support during unprecedented challenges. However, not everyone has taken full advantage of this opportunity, often due to a lack of awareness or difficulty navigating the application process. This guide is designed to simplify the steps involved, ensuring that no one misses out on the benefits they deserve.

Who Qualifies for Pandemic Stimulus Checks?

To qualify for pandemic-era stimulus checks, individuals must meet specific eligibility criteria established by the IRS. These checks were distributed in three distinct rounds, each with its own set of requirements:

Eligibility Criteria

- First Round: Issued in 2020, eligible individuals included those earning up to $75,000 annually, with reduced amounts for higher earners.

- Second Round: Distributed in early 2021, this round expanded eligibility to include mixed-status couples and dependents aged 17 and older.

- Third Round: Issued in March 2021, this round provided larger payments and extended eligibility to additional dependents.

It's important to note that eligibility may vary depending on factors such as income level, filing status, and the number of dependents claimed. For a comprehensive understanding, refer to the IRS website or consult a tax professional.

IRS Guidelines for Claiming Stimulus Checks

The IRS has established clear guidelines to assist individuals in claiming their stimulus checks. These guidelines aim to streamline the process, reduce confusion, and ensure accessibility for eligible recipients.

Steps to Follow

- Verify Eligibility: Confirm whether you meet the criteria for receiving a stimulus check.

- Check Payment Status: Use the IRS's Get My Payment tool to track the status of your check.

- File a Recovery Rebate Credit: If you believe you're owed a stimulus check but haven't received it, file a Recovery Rebate Credit when submitting your tax return.

By following these guidelines, individuals can ensure they receive their entitled funds without unnecessary delays or complications.

Read also:Discover The Allure Of Argentina A Comprehensive Guide

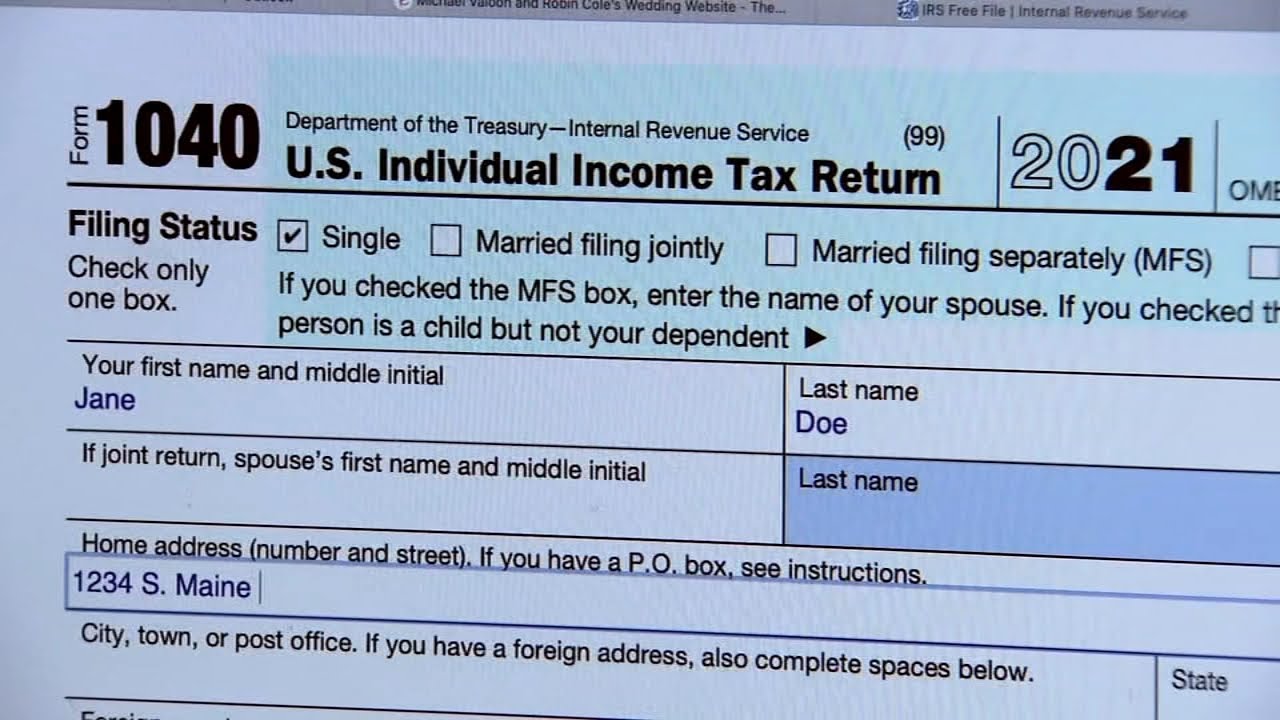

How to Claim Your Stimulus Check

Claiming your stimulus check is a straightforward process, especially for those who have already filed their taxes. However, for individuals who missed out on previous rounds or haven't received their checks, additional steps may be necessary.

Steps to Claim

- File Your Tax Return: Ensure you've filed your most recent tax return, as the IRS uses this information to determine eligibility and payment amounts.

- Claim the Recovery Rebate Credit: If you're owed a stimulus check but haven't received it, include the Recovery Rebate Credit on your tax return.

- Submit Supporting Documents: Provide any necessary documentation, such as proof of income or dependent information, to support your claim.

By following these steps, you can efficiently and effectively secure your stimulus check.

Important Timeline and Deadlines

The IRS has established specific deadlines for claiming pandemic-era stimulus checks. Understanding these timelines is essential to avoid missing out on your entitled benefits.

Key Dates

- Final Deadline: The IRS has announced that the final deadline for claiming stimulus checks is approaching. Ensure you submit your claim before this date.

- Tax Filing Deadline: If you need to file a tax return to claim your stimulus check, ensure it's submitted by the designated deadline.

Staying informed about these deadlines will help you stay on track and ensure timely submission of your claim.

What to Do If You Missed Previous Stimulus Checks

If you missed out on previous rounds of stimulus checks, it's still possible to claim your entitled funds. The IRS offers the Recovery Rebate Credit, allowing eligible individuals to recover missed payments through their tax returns.

Steps to Recover Missed Checks

- File a Tax Return: Even if you're not required to file taxes, doing so can help you claim your Recovery Rebate Credit.

- Include the Credit on Your Return: Ensure the Recovery Rebate Credit is included when filing your tax return.

- Provide Supporting Documentation: Include any necessary documentation to support your claim, such as proof of income or dependent information.

By following these steps, you can recover any missed stimulus checks and secure the benefits you're entitled to.

Common Issues and Solutions

While the process of claiming stimulus checks is generally straightforward, some individuals may encounter challenges. Below are common issues and their solutions:

Resolving Common Issues

- Incorrect Payment Amount: If you believe you received an incorrect payment, contact the IRS or consult a tax professional for assistance.

- Lost or Stolen Check: Report any lost or stolen checks to the IRS immediately and request a replacement.

- Eligibility Disputes: If you believe you were incorrectly deemed ineligible, gather supporting documentation and appeal the decision.

Addressing these issues promptly can help ensure you receive your entitled stimulus funds.

Tax Implications of Stimulus Checks

Understanding the tax implications of stimulus checks is crucial for effective financial planning. While these payments are generally not considered taxable income, certain scenarios may affect their tax status.

Tax Considerations

- Non-Taxable Income: Stimulus checks are typically not subject to federal income tax.

- State Taxes: Check with your state's tax authority, as some states may treat stimulus payments differently.

- Impact on Other Benefits: Understand how receiving a stimulus check may affect other government benefits you receive.

Consulting a tax professional can provide clarity on any potential tax implications of your stimulus check.

Useful Resources for Further Assistance

For those seeking additional information or assistance, several resources are available:

Recommended Resources

- IRS Website: The official IRS website offers comprehensive information on stimulus checks and related programs.

- Tax Professionals: Engaging a certified tax professional can provide personalized guidance and support.

- Community Assistance Programs: Many local organizations offer free or low-cost assistance with tax filings and stimulus check claims.

Utilizing these resources can help ensure a smooth and successful claim process.

Conclusion and Next Steps

As the final deadline for claiming pandemic-era stimulus checks approaches, it's critical for eligible individuals to take immediate action. By understanding eligibility criteria, following IRS guidelines, and addressing any potential issues, you can secure your entitled benefits and alleviate financial stress during these challenging times.

We encourage you to act now by verifying your eligibility, filing your tax return if necessary, and claiming your Recovery Rebate Credit. Share this guide with friends and family to ensure everyone has access to the information they need. For more insights and updates, explore our other articles and resources.