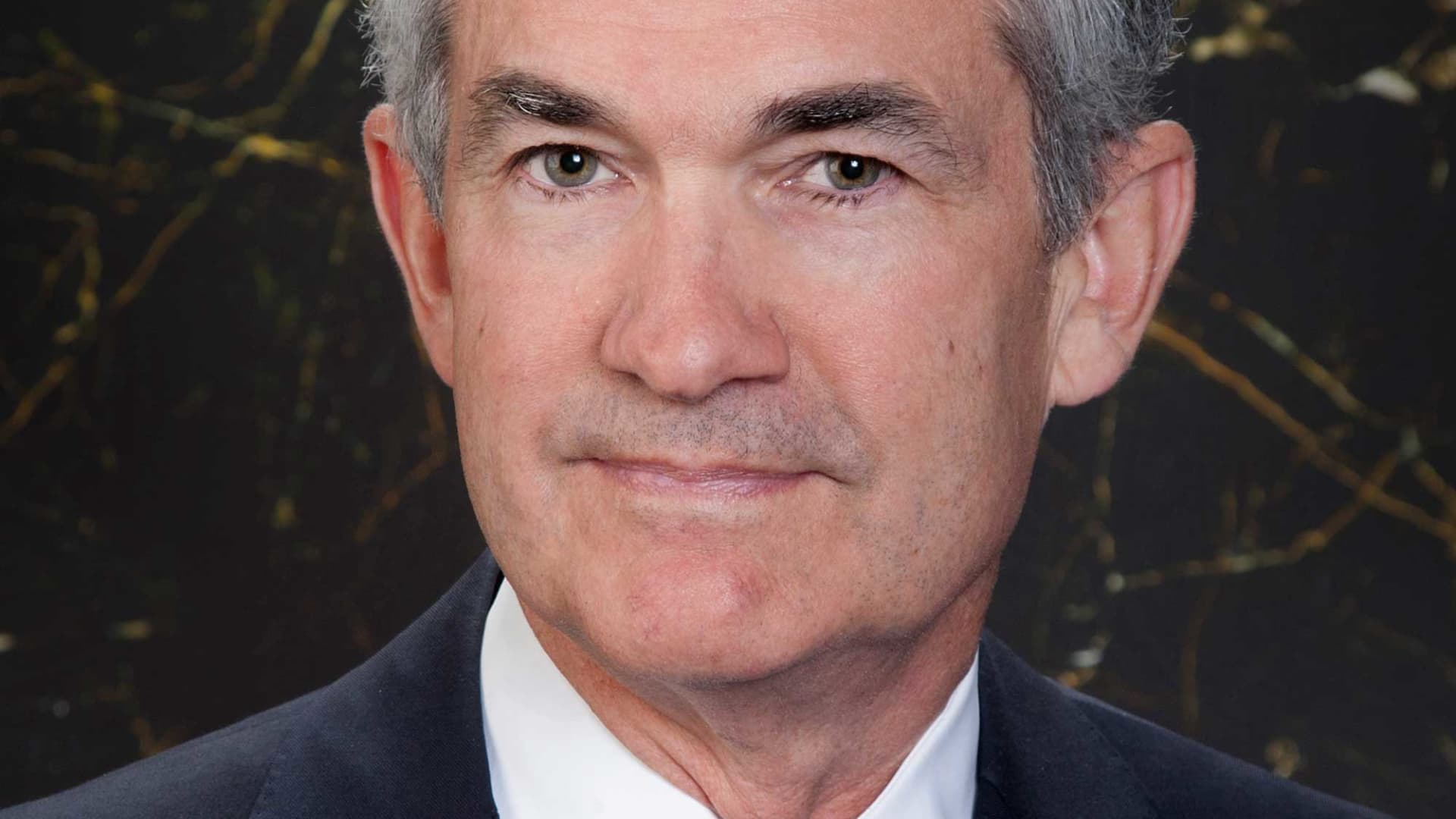

Jerome Powell stands as one of the most influential figures in global finance today. As the Chair of the Federal Reserve, he has played an instrumental role in shaping monetary policy during some of the most challenging economic periods in recent history. His leadership style, strategic policy decisions, and innovative approach to economic challenges have earned him widespread recognition. Whether you're an economist, investor, or simply someone curious about the functioning of global economies, gaining insight into Jerome Powell's contributions is essential for understanding the modern economic landscape.

Throughout his tenure at the Federal Reserve, Jerome Powell has faced unprecedented challenges, ranging from stabilizing the economy post-2008 financial crisis to navigating the disruptions caused by the global pandemic. His ability to adapt swiftly and implement forward-thinking policies has been critical in maintaining economic stability, not just in the United States but across the globe.

This article provides a comprehensive exploration of Jerome Powell's background, leadership, and the policies he has championed as the Federal Reserve Chair. We will trace his journey from a lawyer to becoming one of the most powerful economic policymakers in the world. Furthermore, we will analyze how his decisions impact the U.S. economy and resonate through global financial markets, affecting businesses and households worldwide.

Read also:Exploring The Flames Vs Rangers Rivalry In Nhl Hockey

Table of Contents

- Biography of Jerome Powell

- Early Life and Education

- Career Path Before the Fed

- Becoming the Federal Reserve Chair

- Monetary Policy Under Jerome Powell

- Navigating Economic Crises

- Global Impact of Powell's Policies

- Challenges Faced by Jerome Powell

- Future Outlook and Expectations

- Conclusion

Biography of Jerome Powell

Early Life and Education

Born on February 4, 1953, in Washington, D.C., Jerome Powell grew up in a middle-class family where his early interests were shaped by law and public service. His educational journey began at Princeton University, where he earned a degree in Politics in 1975. This was followed by a Juris Doctor from Georgetown University Law Center in 1979, solidifying his foundation in legal and public policy studies.

Below is a concise summary of Jerome Powell's personal background:

| Full Name | Jerome H. Powell |

|---|---|

| Date of Birth | February 4, 1953 |

| Place of Birth | Washington, D.C. |

| Education | Princeton University (B.A.), Georgetown University Law Center (J.D.) |

| Profession | Lawyer, Economist, Federal Reserve Chair |

Career Path Before the Fed

Prior to his appointment at the Federal Reserve, Jerome Powell cultivated a distinguished career spanning both private and public sectors. After graduating from law school, he worked as an associate at the prestigious law firm Davis Polk & Wardwell. His career in finance commenced at The D.E. Shaw Group, where he served as a partner. In 1997, Powell transitioned to public service, serving as Under Secretary for Domestic Finance at the U.S. Treasury Department, gaining invaluable experience in financial regulation and economic policy.

This extensive background in both financial markets and public policy rendered him an ideal candidate for the Federal Reserve when he was nominated to the Board of Governors in 2011 by President Barack Obama, marking the beginning of his influential tenure in central banking.

Becoming the Federal Reserve Chair

In February 2018, Jerome Powell assumed the role of Chair of the Federal Reserve, succeeding Janet Yellen. His appointment by President Donald Trump symbolized a commitment to the Fed's tradition of non-partisan monetary policy. Powell's leadership is characterized by transparency and collaboration, fostering public trust in the central bank during an era of economic uncertainty.

Throughout his tenure, Powell has navigated a myriad of challenges, including the delicate task of managing interest rates, addressing inflation concerns, and responding to global economic uncertainties. His adaptability and strategic implementation of policies that promote economic stability have garnered widespread acclaim and established him as a pivotal figure in global finance.

Read also:Cleveland Cavaliers Vs Los Angeles Clippers A Deep Dive Into Their Thrilling Rivalry

Monetary Policy Under Jerome Powell

Key Policies Implemented

Under Jerome Powell's stewardship, the Federal Reserve has enacted several pivotal policies aimed at fostering economic growth while ensuring price stability. These include:

- Lowering interest rates during economic downturns to stimulate borrowing and investment, providing a lifeline to struggling businesses and consumers.

- Introducing quantitative easing programs to inject liquidity into the financial system, bolstering market confidence and facilitating economic recovery.

- Adopting a flexible average inflation targeting framework to address inflation concerns more effectively, allowing for a more nuanced approach to monetary policy.

These policies have proven instrumental in stabilizing the economy during periods of uncertainty, promoting recovery, and ensuring sustained economic growth.

Navigating Economic Crises

The Global Financial Crisis

Jerome Powell played a pivotal role in addressing the aftermath of the 2008 financial crisis. His extensive experience in both the private sector and government positions provided him with a unique perspective on financial regulation and risk management. Under his leadership, the Federal Reserve implemented measures to restore confidence in the banking system, preventing another catastrophic collapse and safeguarding the global economy.

The Pandemic Response

When the global pandemic struck in 2020, Jerome Powell and the Federal Reserve acted decisively to mitigate its economic impact. Initiatives such as cutting interest rates to near zero, launching massive bond-buying programs, and providing direct support to businesses and households were instrumental in stabilizing the economy during an unprecedented period of disruption. His leadership ensured that the financial system remained resilient, supporting economic recovery and protecting millions of jobs.

Global Impact of Powell's Policies

Jerome Powell's policies at the Federal Reserve have profound implications that extend far beyond the borders of the United States. As the world's largest economy, decisions made by the Fed influence global financial markets, exchange rates, and international trade. Powell's dedication to transparency and effective communication has helped foster trust among global investors and policymakers, reinforcing the stability of the global financial system.

His efforts to promote global financial stability have earned recognition from prestigious international organizations such as the International Monetary Fund (IMF) and the World Bank, underscoring his role as a global leader in economic policy.

Challenges Faced by Jerome Powell

Political Pressure

As the Chair of the Federal Reserve, Jerome Powell frequently encounters political pressure from both the executive branch and Congress. Navigating the delicate balance between maintaining the Fed's independence and ensuring accountability is a challenging yet crucial aspect of his role. Powell has consistently emphasized the importance of data-driven decision-making, prioritizing economic evidence over political influence to guide monetary policy.

Inflation Concerns

One of the most significant challenges Powell has faced is addressing inflation concerns. Rising prices have prompted calls for tighter monetary policy, yet Powell advocates for a measured approach, emphasizing the necessity of supporting economic recovery while keeping inflation in check. His strategic balance of these competing priorities showcases his expertise and leadership in navigating complex economic dynamics.

Future Outlook and Expectations

As Jerome Powell continues his leadership at the Federal Reserve, his decisions will undoubtedly shape the trajectory of both the U.S. and global economies. With emerging challenges such as climate change, technological disruptions, and geopolitical tensions on the horizon, the Fed will need to adapt its policies to address these evolving issues effectively.

Powell's commitment to transparency, collaboration, and evidence-based decision-making equips him well to navigate these complexities and ensure the long-term stability of the economy, safeguarding the interests of businesses, consumers, and global markets alike.

Conclusion

In summary, Jerome Powell's tenure as the Chair of the Federal Reserve has been defined by resilience, innovation, and an unwavering commitment to economic stability. From his early career as a lawyer to his current role as a leading economic policymaker, Powell's journey exemplifies expertise and dedication. His leadership has been instrumental in navigating some of the most challenging economic periods in recent history, leaving a lasting impact on the global financial landscape.

We encourage you to engage with this article by sharing your thoughts in the comments section below. Your insights on Jerome Powell's leadership and its global implications can enrich the discussion and provide valuable perspectives. Additionally, explore other articles on our site to deepen your understanding of economic issues and trends shaping our world today.

Thank you for reading, and we hope you found this article both informative and engaging.