The federal funds rate, commonly referred to as the fed rate, plays a pivotal role in shaping the United States' monetary policy landscape. This interest rate governs the lending of reserve balances between depository institutions on an overnight basis. Established by the Federal Reserve, the fed rate significantly affects borrowing costs, inflation levels, and the overall health of the economy. For investors, businesses, and consumers, understanding the fed rate is crucial as it directly influences financial decisions and broader market trends.

This article provides a deep dive into the complexities of the fed rate, exploring its determination process, its role in economic policy, and its implications for individuals and businesses. Whether you're a seasoned market participant or someone seeking to understand the broader economic environment, this guide offers valuable insights into the fed rate and its importance.

As we proceed, we will examine the historical context of the fed rate, its connection to inflation, and its influence on global markets. By the conclusion of this article, readers will have a robust understanding of why the fed rate is essential and how it can shape their financial futures.

Read also:Discover The Inspiring Journey Of Sudiksha Rising Star Of The Entertainment World

Table of Contents

- What is the Federal Funds Rate?

- How the Federal Funds Rate Works

- Historical Trends of the Federal Funds Rate

- Impact on the Economy

- Relationship with Inflation

- Global Implications of the Federal Funds Rate

- Factors Influencing the Federal Funds Rate

- Tools Employed by the Federal Reserve

- Challenges and Criticisms

- Future Perspectives

What is the Federal Funds Rate?

The federal funds rate, or fed rate, represents the interest rate at which banks lend their reserve balances to other banks overnight. Established by the Federal Open Market Committee (FOMC), a division of the Federal Reserve, the fed rate acts as a benchmark for other interest rates, impacting everything from mortgage rates to credit card interest rates. It is a critical tool for maintaining economic stability.

The fed rate plays a vital role in shaping economic stability. By adjusting this rate, the Federal Reserve can influence borrowing and spending behaviors, ultimately affecting economic growth. For instance, lowering the fed rate can stimulate economic activity by reducing borrowing costs, while raising it can help control inflation by curbing excessive spending.

Key Characteristics of the Federal Funds Rate

- Set by the Federal Reserve

- Influences short-term interest rates

- Impacts inflation and economic growth

- Serves as a monetary policy tool

How the Federal Funds Rate Works

The federal funds rate operates within the banking system, where banks are required to maintain a specific level of reserves. When a bank has surplus reserves, it can lend them to another bank in need of additional reserves. The interest rate charged for these overnight loans is known as the fed rate.

The Federal Reserve influences the fed rate through open market operations, adjusting the money supply in the economy. By purchasing or selling government securities, the Fed can increase or decrease the amount of money available to banks, thereby impacting the fed rate. This mechanism enables the Fed to implement its monetary policy objectives effectively.

Steps in Establishing the Federal Funds Rate

- Evaluation of economic data

- Analysis of inflation trends

- Adjustment of monetary policy tools

- Decision-making by the FOMC

Historical Trends of the Federal Funds Rate

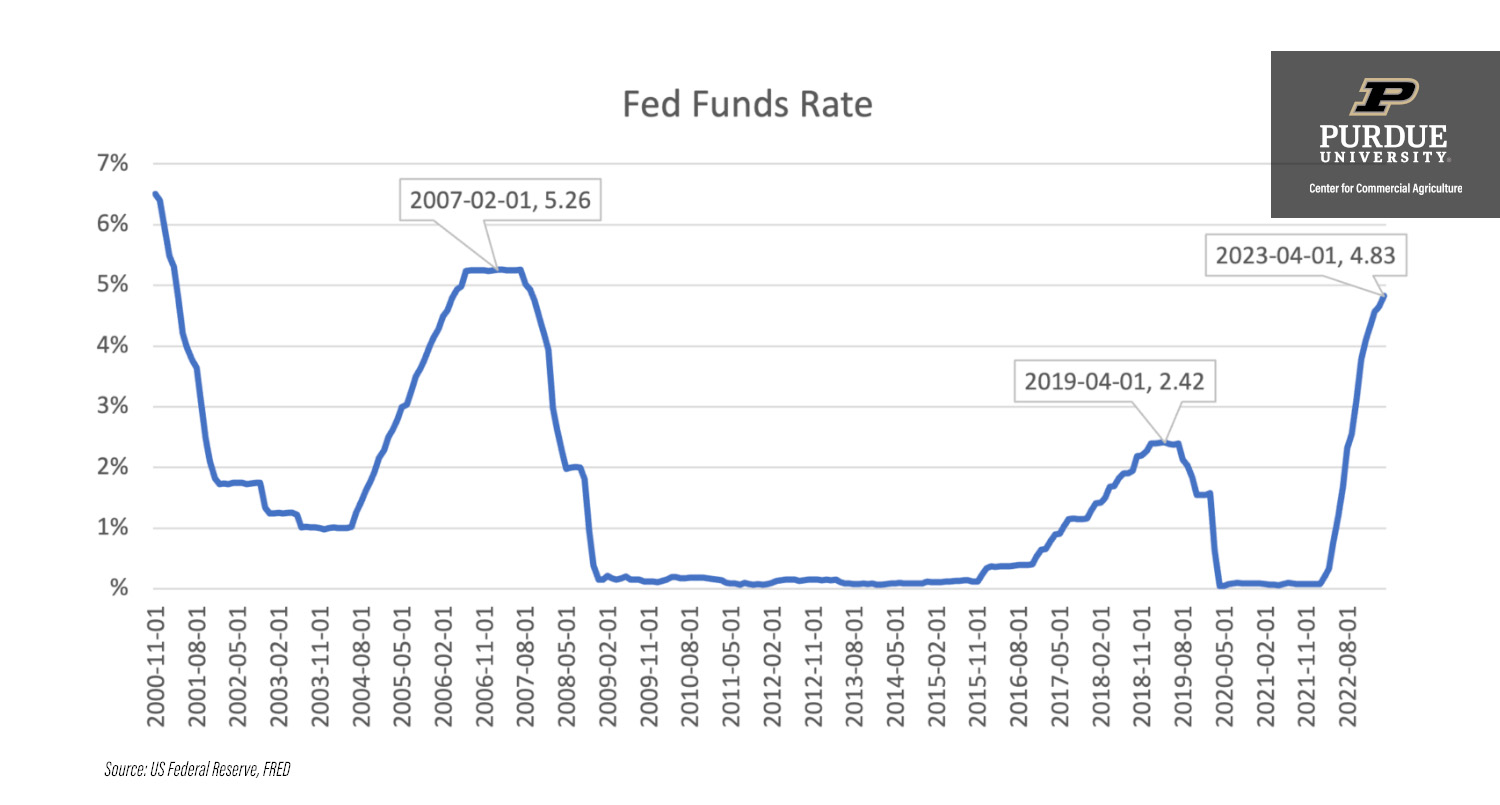

Throughout history, the fed rate has experienced significant fluctuations, reflecting the changing economic environment. During periods of economic prosperity, the Fed often raises the fed rate to prevent overheating and control inflation. Conversely, during economic downturns, the fed rate is typically lowered to encourage borrowing and spending.

For example, during the 2008 financial crisis, the Fed drastically reduced the fed rate to nearly zero to stabilize the economy. In contrast, during the late 1970s and early 1980s, the fed rate reached its peak as the Fed worked to combat high inflation. Understanding these historical trends offers valuable insights into the Fed's decision-making processes and its impact on the economy.

Read also:Exploring The Legacy And Future Of Stanford Basketball

Notable Adjustments in the Federal Funds Rate

- 1980s: High fed rate to address inflation

- 2008: Lowered to near-zero during the financial crisis

- 2020: Emergency cuts in response to the pandemic

Impact on the Economy

The fed rate has a profound influence on the economy, affecting various sectors and stakeholders. By altering the cost of borrowing, the Fed can either stimulate or slow down economic activity. For instance, lower fed rates can lead to increased investment and consumer spending, boosting GDP growth. Conversely, higher fed rates can help control inflation by reducing excessive spending.

Both businesses and consumers are significantly affected by changes in the fed rate. For businesses, lower rates can facilitate expansion and capital investment. For consumers, lower rates can make borrowing for homes, cars, and education more affordable. On the other hand, higher rates can lead to tighter credit conditions and encourage savings.

Sectors Influenced by the Federal Funds Rate

- Real estate and housing

- Banking and finance

- Consumer goods and services

Relationship with Inflation

One of the primary goals of the Federal Reserve is to ensure price stability by controlling inflation. The fed rate serves as a critical tool in achieving this objective. By raising the fed rate, the Fed can mitigate inflationary pressures by making borrowing more expensive and encouraging savings. Conversely, lowering the fed rate can stimulate economic activity and prevent deflation.

The relationship between the fed rate and inflation is intricate and dynamic. The Fed continuously monitors economic indicators to ensure that its monetary policy aligns with its dual mandate of price stability and maximum employment. Balancing these objectives requires a careful assessment of inflation trends and their potential impact on the economy.

Methods for Controlling Inflation

- Raising the fed rate to reduce inflation

- Lowering the fed rate to combat deflation

- Monitoring inflation indicators

Global Implications of the Federal Funds Rate

The fed rate not only influences the U.S. economy but also has substantial global implications. As the world's largest economy, changes in U.S. monetary policy can affect international markets, currencies, and trade. For example, a higher fed rate can strengthen the U.S. dollar, making American exports more expensive and imports cheaper.

Emerging markets are particularly sensitive to changes in the fed rate, as they often depend on foreign capital flows. An increase in the fed rate can lead to capital outflows from emerging markets, raising borrowing costs and potentially destabilizing their economies. Consequently, global investors closely monitor the Fed's decisions to anticipate potential impacts on their investments.

Global Effects of Changes in the Federal Funds Rate

- Impact on foreign exchange rates

- Effects on international trade

- Consequences for emerging markets

Factors Influencing the Federal Funds Rate

Several factors influence the Federal Reserve's decision to adjust the fed rate. These include economic indicators such as GDP growth, unemployment rates, and inflation data. Additionally, geopolitical events, global economic conditions, and financial market stability can also play a role in the Fed's decision-making process.

The Fed considers both domestic and international factors when setting the fed rate. By analyzing a wide range of data, the Fed aims to make informed decisions that promote economic stability and sustainable growth. This comprehensive approach ensures that monetary policy remains aligned with the Fed's objectives.

Key Factors Affecting Fed Rate Decisions

- Economic growth indicators

- Inflation and unemployment data

- Global economic conditions

Tools Employed by the Federal Reserve

Beyond adjusting the fed rate, the Federal Reserve utilizes various tools to implement its monetary policy. These include open market operations, quantitative easing, and forward guidance. Each tool serves a specific purpose in achieving the Fed's objectives and maintaining economic stability.

Open market operations involve buying and selling government securities to influence the money supply. Quantitative easing is employed during periods of economic distress to inject liquidity into the financial system. Forward guidance, meanwhile, involves communicating the Fed's future policy intentions to influence market expectations.

Monetary Policy Tools

- Open market operations

- Quantitative easing

- Forward guidance

Challenges and Criticisms

Despite its critical role in economic management, the Fed's use of the fed rate as a policy tool faces challenges and criticism. Some argue that excessive reliance on monetary policy can lead to unintended consequences, such as asset bubbles or increased income inequality. Moreover, the Fed struggles to balance its dual mandate in an increasingly complex global economy.

Critics also contend that the Fed's decisions can have disproportionate effects on different sectors of the economy. For instance, while lower rates can benefit borrowers, they can negatively impact savers and retirees who depend on interest income. Addressing these challenges requires continuous evaluation and adaptation of monetary policy strategies.

Common Criticisms of Fed Rate Policy

- Potential for asset bubbles

- Increased income inequality

- Disproportionate sectoral impacts

Future Perspectives

Looking ahead, the role of the fed rate in shaping economic policy is likely to remain significant. As the global economy continues to evolve, the Fed will need to adapt its strategies to address new challenges and opportunities. This may involve exploring innovative monetary policy tools and enhancing communication with the public and markets.

In an era of technological advancement and shifting global dynamics, the Fed's ability to navigate uncertainty will be crucial. By adopting a flexible and forward-thinking approach, the Fed can continue to promote economic stability and sustainable growth, ensuring that the fed rate remains a vital instrument in its policy toolkit.

Expected Future Developments

- Innovative monetary policy tools

- Enhanced communication strategies

- Adaptation to global economic changes

Conclusion

In summary, the federal funds rate is a cornerstone of U.S. monetary policy, influencing economic activity, inflation, and global markets. By understanding its mechanisms and implications, individuals and businesses can make informed financial decisions. As the Fed continues to navigate the complexities of the modern economy, its role in maintaining stability and promoting growth will remain indispensable.

We encourage readers to share their thoughts and insights in the comments section below. Additionally, feel free to explore other articles on our website for more in-depth analysis of economic topics. Together, we can deepen our understanding of the forces shaping our financial world.