The interest rates established by the Federal Reserve (Fed) are pivotal in steering the U.S. economy, influencing a wide range of factors from borrowing expenses to investment strategies. The Fed's interest rates represent one of the most influential tools available to the central bank for managing inflation, employment levels, and ensuring overall economic stability. Gaining insight into how these rates function and their impact on daily life is crucial for anyone aiming to make well-informed financial decisions.

The decision-making process of the Federal Reserve regarding interest rates is a sophisticated and intriguing area of study. This process involves analyzing extensive economic data, considering international trends, and forecasting future economic scenarios. The decisions made by the Fed resonate throughout the financial system, affecting aspects such as mortgage rates and credit card interest charges.

This article aims to explore the realm of Fed interest rates in depth, examining their significance, the methods by which they are determined, their influence on the economy, and the monetary policy instruments employed by the Fed. Whether you are an investor, a business proprietor, or simply someone eager to comprehend how the economy operates, this guide will offer valuable knowledge into one of the most essential components of contemporary finance.

Read also:Kyle Kuzma The Journey Of An Inspiring Nba Star

Table of Contents

- Introduction to Fed Interest Rates

- The Federal Reserve: Who They Are and What They Do

- Factors Affecting Fed Interest Rates

- Impact of Fed Interest Rates on the Economy

- Monetary Policy Tools Used by the Fed

- Historical Perspective: Fed Interest Rates Over Time

- Current Trends in Fed Interest Rates

- Forecasting the Future of Fed Interest Rates

- Fed Interest Rates and Personal Finance

- Conclusion and Call to Action

Exploring the Fundamentals of Fed Interest Rates

Defining Fed Interest Rates

Fed interest rates refer to the benchmark interest rates established by the Federal Reserve to guide the U.S. economy. Among these, the federal funds rate is the most recognized, representing the interest rate at which banks lend reserve balances to other banks overnight. This rate serves as the cornerstone for other interest rates, impacting a spectrum of financial activities, from consumer loans to corporate borrowing.

The Fed modifies these rates to either stimulate economic growth during periods of decline or to temper an economy that is expanding too rapidly. By reducing interest rates, the Fed promotes borrowing and spending, whereas raising rates can help control inflation by increasing the cost of borrowing.

The Importance of Fed Interest Rates

Fed interest rates are of great importance because they influence the cost of borrowing for both consumers and businesses. When rates are low, it becomes more affordable to secure loans for significant purchases such as homes, cars, or business investments. In contrast, higher rates can deter excessive spending and borrowing, contributing to economic stability.

Furthermore, these rates have a global impact, given the prominence of the U.S. dollar as a major reserve currency. Shifts in Fed interest rates can affect currency values, trade balances, and international investment flows.

Understanding the Federal Reserve: Its Role and Functions

The Federal Reserve System, commonly referred to as the Fed, is the central banking system of the United States. Established in 1913, its main objectives are to promote maximum employment, ensure stable prices, and maintain moderate long-term interest rates.

- Monetary Policy: The Fed implements monetary policy to achieve its objectives, utilizing tools such as adjustments to interest rates and open market operations.

- Supervision and Regulation: The Fed monitors banks and financial institutions to ensure stability and safeguard consumers.

- Financial Services: The Fed provides financial services to the U.S. government, financial institutions, and foreign official entities.

Key Factors Influencing Fed Interest Rates

Economic Indicators

When setting interest rates, the Fed takes into account a broad array of economic indicators. These include inflation rates, unemployment levels, GDP growth, and patterns of consumer spending. For instance, if inflation is accelerating too rapidly, the Fed might increase interest rates to slow down spending and regain control over prices.

Read also:Alex Verdugo The Rising Star Of Major League Baseball

Global Economic Conditions

Global economic conditions also significantly influence the Fed's decisions. Events such as trade disputes, geopolitical instability, or financial crises in other countries can impact the Fed's strategies. Given the interconnectedness of global markets, the Fed must consider the larger context when determining interest rates.

The Effects of Fed Interest Rates on the Economy

Influence on Borrowing and Lending

Fed interest rates have a direct impact on borrowing and lending activities. Lower rates encourage businesses to invest in new ventures and consumers to secure loans for major purchases. Conversely, higher rates can discourage borrowing and result in reduced spending.

Impact on Savings and Investments

For savers and investors, Fed interest rates affect the returns on savings accounts, certificates of deposit, and other fixed-income investments. Higher rates typically offer better returns for savers, while lower rates may lead investors to pursue higher yields in riskier assets.

Monetary Policy Instruments Utilized by the Fed

Federal Funds Rate

The federal funds rate is the primary tool the Fed uses to influence the economy. By setting a target range for this rate, the Fed can guide short-term interest rates across the financial system.

Open Market Operations

Open market operations involve the buying and selling of government securities to influence the money supply. When the Fed purchases securities, it injects money into the economy, potentially lowering interest rates. Selling securities has the opposite effect.

A Historical Overview: Fed Interest Rates Through the Ages

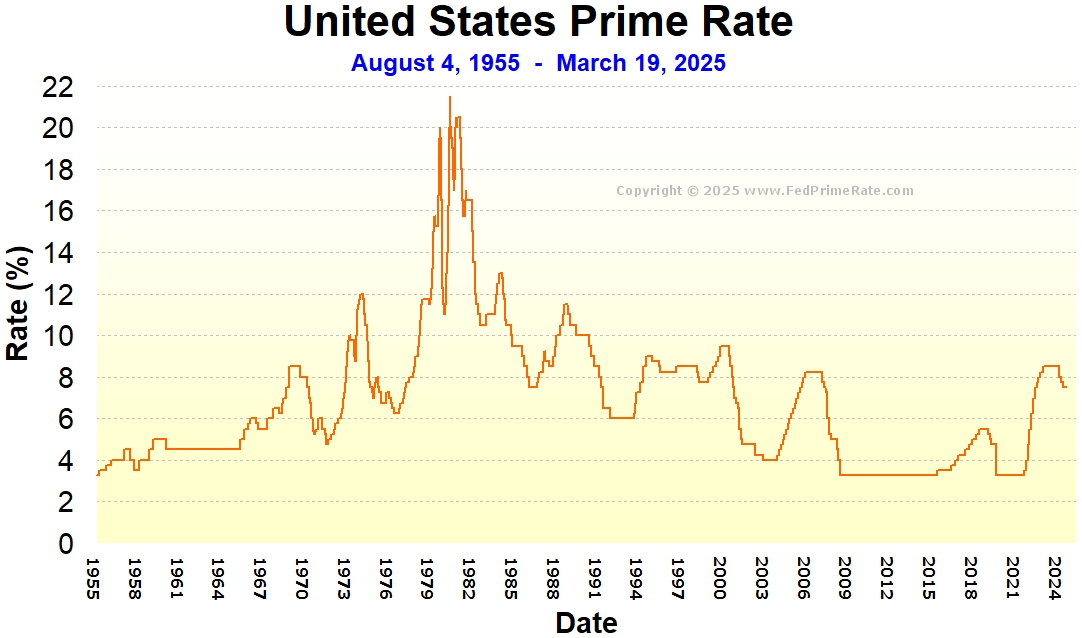

By reviewing historical trends, we can observe how Fed interest rates have adapted in response to evolving economic conditions. For example, during the 1980s, the Fed sharply increased rates to combat high inflation. In contrast, during the 2008 financial crisis, rates were reduced to near zero to stimulate recovery.

Recent Developments in Fed Interest Rates

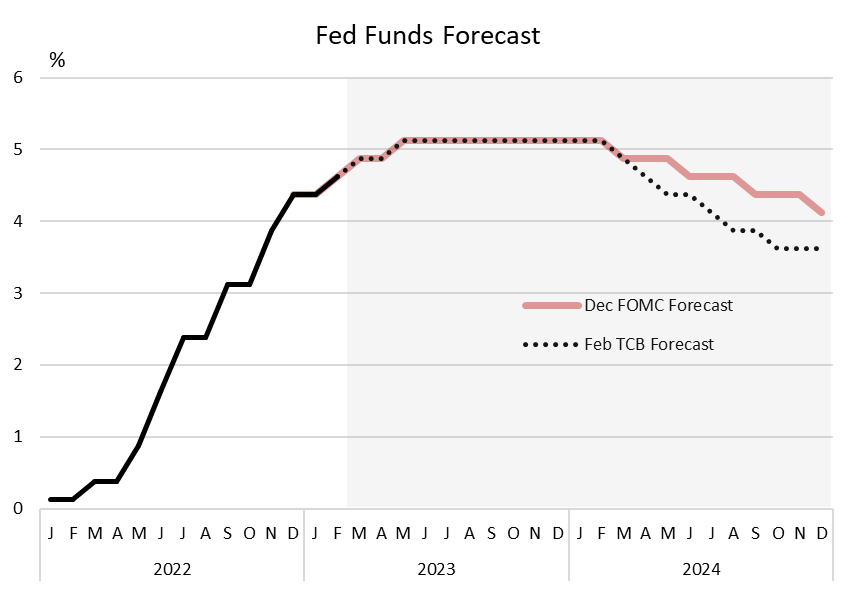

Based on the most recent data, the Fed has been progressively raising interest rates to address rising inflation concerns. This trend demonstrates the central bank's dedication to maintaining price stability while supporting economic growth.

Predicting the Trajectory of Fed Interest Rates

Forecasting future moves in Fed interest rates entails analyzing current economic data, policy statements, and market expectations. While predictions are inherently uncertain, economists often examine indicators such as inflation trends, employment figures, and global economic conditions to make informed projections.

Fed Interest Rates and Their Influence on Personal Finance

Impact on Mortgage Rates

Changes in Fed interest rates can substantially affect mortgage rates. When the Fed lowers rates, it becomes less expensive to finance a home purchase, potentially boosting home sales and construction activity.

Effect on Credit Card Rates

Credit card interest rates are often linked to the prime rate, which is influenced by the federal funds rate. Consequently, changes in Fed interest rates can directly impact the cost of carrying a credit card balance.

Summary and Next Steps

In summary, comprehending Fed interest rates is vital for anyone interested in the economy or personal finance. These rates play a central role in shaping economic conditions, influencing a range of factors from borrowing costs to investment opportunities. By staying informed about Fed policies and their implications, you can make better financial decisions and navigate the economic landscape more effectively.

We invite you to share your thoughts and questions in the comments section below. Additionally, feel free to explore other articles on our site for more insights into the world of finance and economics. Together, let's cultivate a more knowledgeable and financially astute community!

Data Source: Federal Reserve