The Federal Reserve, often referred to simply as "the Fed," is a cornerstone of the U.S. financial system, influencing everything from interest rates to employment levels. For investors, businesses, and individuals, staying informed about the latest Fed news is essential for making sound financial decisions. This comprehensive guide will explore the significance of Fed news, its impact on the economy, and how you can stay updated on the latest developments.

The Federal Reserve's announcements and policy decisions have far-reaching consequences for the economy. From mortgage rates to stock market performance, the Fed's actions affect nearly every aspect of financial life. As a result, understanding Fed news has become crucial for navigating the complexities of modern finance. This article will break down complex concepts into clear, digestible information, empowering readers of all backgrounds to better comprehend the Federal Reserve's role and its implications for the global economy.

Table of Contents

- What is Fed News?

- Why Fed News Matters

- The Structure of the Federal Reserve

- Key Functions of the Federal Reserve

- How Fed News Affects the Economy

- How to Stay Informed About Fed News

- The Historical Context of the Federal Reserve

- Recent Developments in Fed News

- Future Trends in Fed News

- Conclusion

What is Fed News?

Fed news encompasses the announcements, reports, and updates issued by the Federal Reserve System. These updates cover a wide range of topics, including interest rate decisions, economic forecasts, and policy changes. The Federal Reserve, often referred to as "the Fed," is the central banking system of the United States, tasked with maintaining monetary stability and fostering economic growth. Understanding Fed news requires familiarity with the organization's structure and its various functions.

Read also:The Inspiring Journey Of Natalia Grace A Multifaceted Entertainer

The Federal Reserve is composed of the Board of Governors, 12 regional Federal Reserve Banks, and the Federal Open Market Committee (FOMC). Each component plays a vital role in shaping monetary policy and influencing economic conditions. For instance, the FOMC meets regularly to set target interest rates, which directly affect borrowing costs for consumers and businesses. Additionally, the Fed releases quarterly projections for GDP growth, unemployment rates, and inflation, providing valuable insights into the state of the economy.

Key Components of Fed News

- Interest Rate Decisions: The FOMC's decisions on interest rates are among the most closely watched aspects of Fed news. These decisions impact borrowing costs, affecting everything from mortgages to business loans.

- Economic Projections: The Federal Reserve provides regular forecasts for key economic indicators, offering a glimpse into its expectations for the future.

- Policy Statements: Official statements from the Fed outline its current stance on economic conditions and provide guidance on future policy directions.

Why Fed News Matters

Fed news is critical for anyone involved in the financial markets or concerned about the broader economy. Its importance stems from the Federal Reserve's role as the central bank of the United States, granting it the authority to influence monetary conditions through its policies. Whether you're an investor, a business owner, or an individual managing personal finances, staying informed about Fed news can help you make better financial decisions.

Why Should You Care About Fed News?

- Investment Decisions: Fed news can significantly impact stock prices, bond yields, and currency values, making it essential for investors seeking to optimize their portfolios.

- Business Operations: Companies rely on Fed news to anticipate changes in interest rates and economic conditions, allowing them to plan for the future more effectively.

- Personal Finance: Individuals can use Fed news to make informed decisions about loans, savings, and investments, ensuring their financial well-being.

For example, when the Fed announces a rate hike, it can lead to higher borrowing costs for consumers and businesses, affecting everything from car loans to credit card interest rates. Conversely, a rate cut may stimulate economic activity by making borrowing more affordable, encouraging spending and investment.

The Structure of the Federal Reserve

The Federal Reserve System is designed to ensure independence and accountability in its operations. It consists of three main components, each playing a unique role in shaping monetary policy and maintaining financial stability.

Board of Governors

The Board of Governors, headquartered in Washington, D.C., oversees the Federal Reserve System. It is responsible for setting monetary policy, regulating banks, and supervising financial institutions. The board is composed of seven members appointed by the President and confirmed by the Senate, ensuring a balance of expertise and perspective.

Regional Federal Reserve Banks

Twelve regional Federal Reserve Banks operate across the United States, serving as the operational arms of the Federal Reserve System. These banks provide services to depository institutions, implement monetary policy decisions, and gather economic data from their respective regions, offering valuable insights into local economic conditions.

Read also:Discovering Aj Storr A Deep Dive Into The Life And Legacy Of A Digital Icon

Federal Open Market Committee (FOMC)

The FOMC is responsible for conducting the nation's monetary policy. It consists of the seven members of the Board of Governors and five of the 12 regional Federal Reserve Bank presidents. The committee meets eight times a year to review economic and financial conditions, assess risks to the economy, and determine appropriate monetary policy actions.

Key Functions of the Federal Reserve

The Federal Reserve performs several critical functions that contribute to the stability and growth of the U.S. economy. These functions ensure that the financial system operates efficiently and that economic conditions remain favorable for businesses and consumers alike.

Monetary Policy

One of the Federal Reserve's primary responsibilities is managing monetary policy. Through tools such as interest rate adjustments and quantitative easing, the Fed seeks to control inflation, promote employment, and stabilize the economy. By influencing borrowing and spending behavior, the Fed plays a crucial role in maintaining economic equilibrium.

Bank Supervision and Regulation

The Federal Reserve supervises and regulates banks and other financial institutions to ensure their safety and soundness. This includes enforcing consumer protection laws and promoting fair lending practices, helping to build trust in the financial system and protect consumers from predatory practices.

Financial Services

The Federal Reserve provides essential financial services to depository institutions, the U.S. government, and foreign official institutions. These services include processing payments, clearing checks, and managing the country's monetary reserves, ensuring the smooth functioning of the financial system.

How Fed News Affects the Economy

Fed news has a profound impact on the economy, influencing various sectors and stakeholders. Below are some of the key ways in which Fed news shapes economic conditions:

Interest Rates

Changes in interest rates set by the Federal Reserve directly affect borrowing costs for consumers and businesses. Higher rates can slow economic growth by making loans more expensive, while lower rates can stimulate spending and investment, boosting economic activity.

Inflation

The Federal Reserve targets an inflation rate of around 2%, using a variety of tools to achieve this goal. Fed news about inflation expectations can influence consumer behavior and business planning, as individuals and companies adjust their strategies to account for changing price levels.

Employment

As part of its dual mandate, the Federal Reserve aims to promote maximum employment. Fed news regarding job growth and unemployment rates provides valuable insights into the health of the labor market, helping policymakers and businesses make informed decisions.

How to Stay Informed About Fed News

With the rise of digital technology, staying updated on Fed news has never been easier. Below are some of the best ways to follow the latest developments:

Official Federal Reserve Website

The Federal Reserve's official website is the most reliable source for up-to-date Fed news. It provides press releases, economic data, policy statements, and other valuable resources, ensuring that you have access to the latest information straight from the source.

Financial News Outlets

Reputable financial news outlets such as Bloomberg, CNBC, and Reuters offer comprehensive coverage of Fed news. These platforms not only report on the latest developments but also provide expert analysis and commentary, helping you understand the implications of policy decisions.

Social Media

Following Fed officials and economists on social media platforms like Twitter can provide real-time updates and insights into their thinking. Many Fed leaders are active on social media, sharing their views on economic conditions and policy decisions, making it easier than ever to stay informed.

The Historical Context of the Federal Reserve

To fully appreciate the importance of Fed news, it is essential to understand the historical context of the Federal Reserve. Established in 1913 by the Federal Reserve Act, the Fed was created to address the financial instability that plagued the U.S. economy in the early 20th century. Over the years, the Fed has evolved to meet the challenges of a rapidly changing economic landscape.

The Great Depression

During the Great Depression of the 1930s, the Federal Reserve faced criticism for failing to prevent the collapse of the banking system. This experience led to significant reforms, including the establishment of deposit insurance and increased regulatory oversight, ensuring greater stability in the financial system.

The 2008 Financial Crisis

The 2008 financial crisis highlighted the Federal Reserve's role in crisis management. The Fed implemented unprecedented measures, such as quantitative easing and emergency lending programs, to stabilize the financial system and prevent a global economic meltdown. These actions demonstrated the Fed's ability to adapt to new challenges and maintain economic stability.

Recent Developments in Fed News

In recent years, the Federal Reserve has faced numerous challenges, including the aftermath of the 2008 financial crisis, the impact of the COVID-19 pandemic, and rising inflation concerns. Below are some of the key developments in Fed news:

Pandemic Response

In response to the economic disruptions caused by the pandemic, the Federal Reserve took swift action, lowering interest rates to near zero and launching large-scale asset purchase programs. These measures helped stabilize financial markets and support economic recovery, demonstrating the Fed's ability to respond to crises effectively.

Inflation Concerns

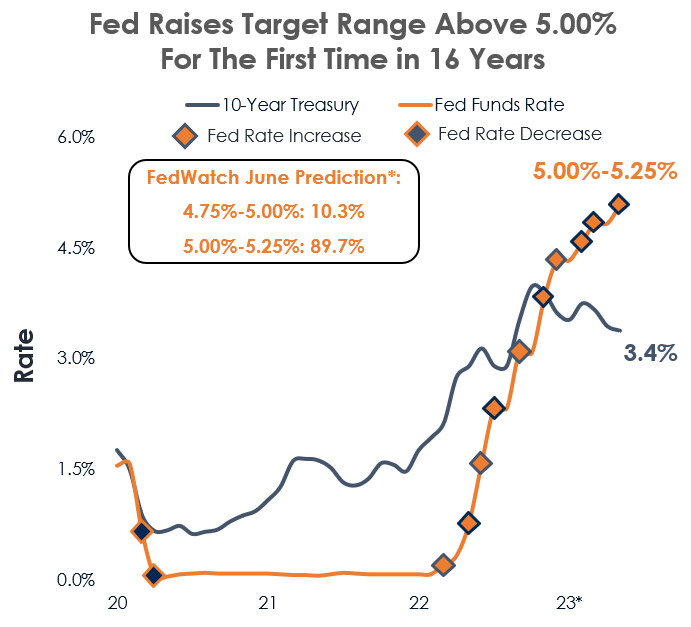

As the economy rebounded from the pandemic, concerns about inflation intensified. The Federal Reserve has signaled its willingness to raise interest rates to combat rising prices, balancing the need for economic growth with price stability. This approach reflects the Fed's commitment to maintaining a healthy and stable economy.

Future Trends in Fed News

Looking ahead, the Federal Reserve will continue to play a crucial role in shaping the economic landscape. Below are some of the key areas of focus for the future:

Interest Rate Policy

With inflation remaining a concern, the Federal Reserve may continue to raise interest rates in the coming months. The pace and extent of these rate hikes will depend on economic data and global developments, making it essential to stay informed about the latest Fed news.

Climate Change

The Federal Reserve is increasingly recognizing the importance of addressing climate change risks. Future Fed news may include initiatives to incorporate climate considerations into monetary policy and financial stability assessments, reflecting the growing recognition of environmental factors in economic decision-making.

Conclusion

Fed news is an indispensable resource for anyone seeking to understand the forces shaping the U.S. economy. By staying informed about the Federal Reserve's actions and policies, individuals and businesses can make better financial decisions and navigate the complexities of the modern economic environment. We encourage you to share this article with others who may benefit from its insights and to explore our other resources on economic topics and financial literacy. Together, let's build a more informed and prosperous future.

References:

- Federal Reserve Board. (2023). Monetary Policy.

- Board of Governors of the Federal Reserve System. (2023). Economic Data.

- Bloomberg. (2023). Fed News Analysis.