In today’s financial landscape, interest rates play a crucial role in shaping the financial decisions of individuals and businesses alike. Whether you're saving for the future, borrowing for a major purchase, or investing in the market, a solid understanding of interest rates can greatly enhance your financial well-being. This article dives deep into the complexities of interest rates, offering valuable insights to help you navigate the ever-changing financial environment.

The financial world is constantly evolving, and staying informed about interest rates is essential for making sound financial decisions. From central bank policies to global economic trends, numerous factors influence the fluctuations in interest rates. This guide will provide a detailed overview of the current state of interest rates, their implications, and practical strategies to optimize your financial health.

By the time you finish reading this article, you'll have a comprehensive understanding of how interest rates impact loans, savings, investments, and the broader economy. Let's explore the fascinating world of interest rates and discover how they shape our financial futures.

Read also:The Rise Of Jess Hilarious A Journey Through Laughter And Success

Table of Contents

- What Are Interest Rates?

- Types of Interest Rates

- Factors Affecting Interest Rates Today

- Current Interest Rates Overview

- Impact on Loans

- Impact on Savings

- Investment Perspectives

- Global Perspective

- Strategies for Financial Planning

- Conclusion

What Are Interest Rates?

Interest rates are the percentage charged or earned on loans or deposits. They represent the cost of borrowing money or the return on savings and investments. Understanding interest rates is foundational for anyone engaged in financial transactions, as they influence everything from personal loans to large-scale investments.

For borrowers, interest rates determine the total cost of repaying a loan over time. For savers, they dictate the growth potential of their money. Central banks, such as the Federal Reserve in the United States, play a pivotal role in setting benchmark interest rates that serve as a foundation for the broader financial market.

How Interest Rates Are Determined

The determination of interest rates involves several key factors:

- Economic growth and inflation levels

- Monetary policies implemented by central banks

- Supply and demand dynamics in the credit market

- Global economic conditions and geopolitical events

These factors work together to shape the interest rates we experience today, making them a dynamic and ever-changing element of the financial system.

Types of Interest Rates

Interest rates come in various forms, each serving a distinct purpose within the financial ecosystem. Below are some of the most common types:

Nominal Interest Rate

The nominal interest rate is the stated rate on a loan or deposit, not adjusted for inflation. It serves as the base cost of borrowing or the base return on savings, providing a straightforward measure of financial transactions.

Read also:Enhancing Your Mlb Experience A Comprehensive Guide To Scores

Real Interest Rate

The real interest rate takes inflation into account, offering a more accurate reflection of the true cost of borrowing or the actual return on savings. The formula for calculating the real interest rate is:

Real Interest Rate = Nominal Interest Rate - Inflation Rate

Fixed vs. Variable Interest Rates

Fixed interest rates remain constant throughout the life of a loan or deposit, providing stability and predictability. In contrast, variable interest rates can fluctuate based on market conditions, offering potential benefits or risks depending on economic trends. Borrowers and investors must carefully evaluate which type aligns best with their financial goals.

Factors Affecting Interest Rates Today

Interest rates today are influenced by a wide range of factors. Let’s examine the most significant ones:

Economic Growth

Strong economic growth often prompts central banks to raise interest rates to prevent overheating and control inflation. Conversely, during economic downturns, central banks may lower interest rates to stimulate borrowing and spending, encouraging economic recovery.

Inflation

Inflation has a direct impact on interest rates. Central banks typically increase interest rates to combat rising inflation and decrease them during periods of deflation, ensuring price stability within the economy.

Monetary Policy

Central banks utilize monetary policy tools to manage interest rates effectively. For instance, the Federal Reserve in the United States adjusts the federal funds rate, influencing short-term interest rates across the economy. These policy decisions ripple through financial markets, affecting borrowing and saving costs.

Current Interest Rates Overview

As of the latest data, interest rates today vary significantly depending on the type of financial product and geographic location. Below is a snapshot of current interest rates in key areas:

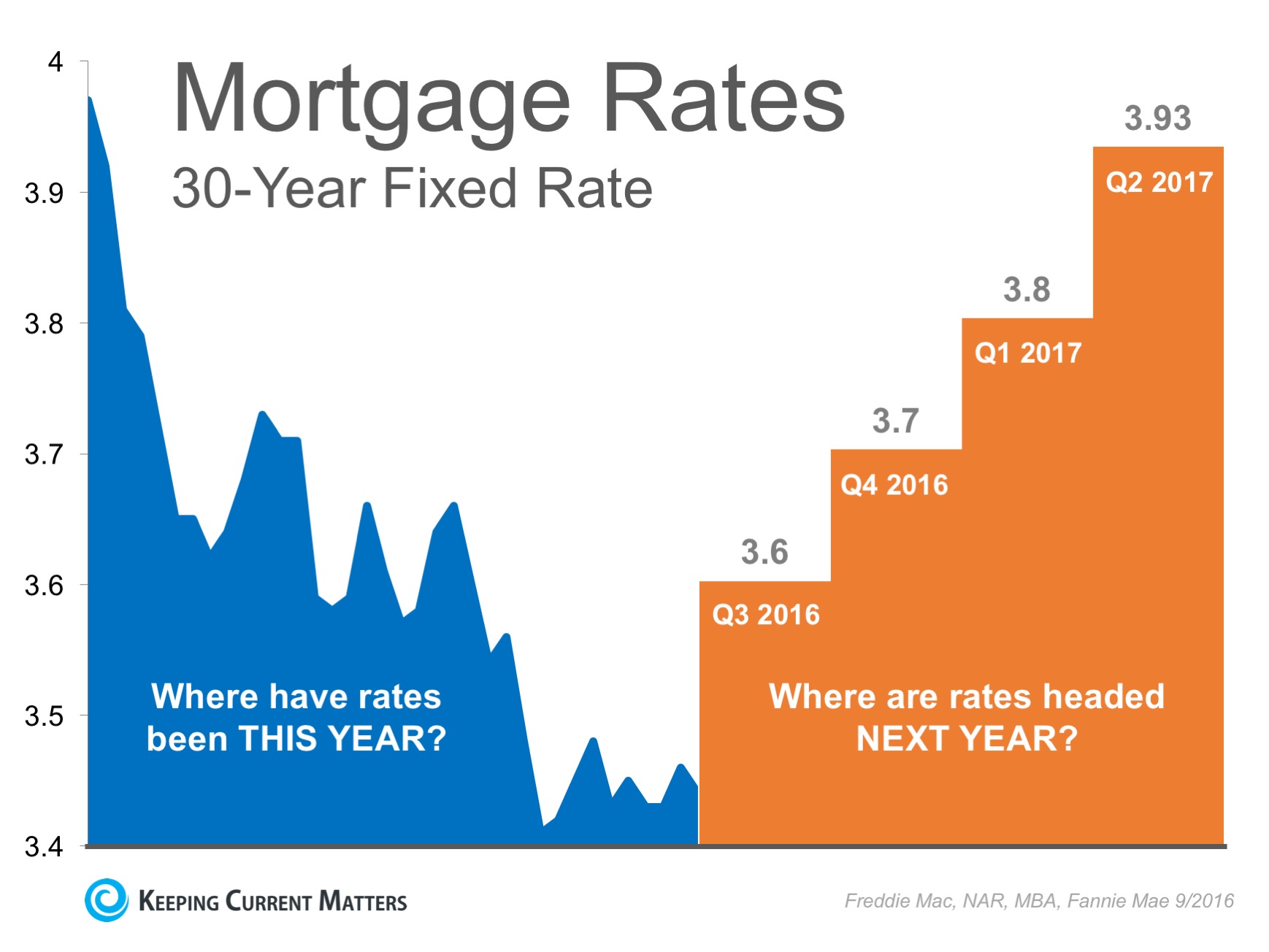

Mortgage Rates

Mortgage rates have experienced an upward trend due to recent actions by the Federal Reserve. As of this writing, the average 30-year fixed mortgage rate stands at 6.5%, marking a notable increase compared to previous years. This rise affects both homebuyers and those considering refinancing options.

Savings Accounts

Savings account interest rates have also seen changes, with high-yield savings accounts now offering rates in the range of 4-5%. This makes them an increasingly attractive option for savers seeking better returns on their deposits.

Impact on Loans

Interest rates today have a profound effect on loans, influencing the financial obligations of borrowers. Below are some key areas where interest rates impact loans:

Consumer Loans

Personal loans, auto loans, and credit card interest rates are all influenced by current market conditions. Higher interest rates lead to increased monthly payments for borrowers, making it more challenging to manage budgets effectively.

Business Loans

For businesses, interest rates today play a critical role in determining their ability to secure financing for expansion or operational needs. Rising rates may discourage borrowing, while lower rates can encourage investment, fostering business growth.

Impact on Savings

Savers benefit from higher interest rates today, as their deposits earn more interest. However, the interplay between inflation and interest rates must be carefully considered. Below are some considerations for savers:

High-Yield Savings Accounts

With interest rates on the rise, high-yield savings accounts offer attractive returns. Savers are encouraged to compare rates across different institutions to maximize their earnings potential.

Certificates of Deposit (CDs)

CDs provide fixed interest rates for a predetermined period. As interest rates increase, new CDs offer higher returns, making them an appealing option for those planning for long-term savings.

Investment Perspectives

Investors closely monitor interest rates today to refine their strategies. Changes in rates can significantly impact stock and bond markets, as well as real estate investments. Below are some investment considerations:

Stock Market

Rising interest rates can lead to lower stock prices, as borrowing costs for companies increase. Investors must adjust their portfolios accordingly to manage risk effectively while seeking opportunities in a changing market.

Bond Market

Bond prices and interest rates share an inverse relationship. When interest rates rise, existing bond prices fall, affecting the returns for bondholders. Understanding this dynamic is crucial for investors navigating the bond market.

Global Perspective

Interest rates today are not confined to individual countries but are influenced by global economic conditions and central bank policies. Below are some global trends:

U.S. Federal Reserve

The decisions made by the U.S. Federal Reserve on interest rates have far-reaching effects globally. As the world's largest economy, its policies impact international markets, influencing interest rates and investment opportunities worldwide.

European Central Bank

Similarly, the European Central Bank's actions affect interest rates in the Eurozone. Divergent monetary policies between regions can create both opportunities and challenges for investors, requiring a nuanced approach to global investing.

Strategies for Financial Planning

Navigating interest rates today requires a strategic approach. Below are some practical tips for effective financial planning:

Budgeting

Create a detailed budget that accounts for potential fluctuations in interest rates. Prioritize high-interest debt and adjust spending habits as needed to maintain financial stability.

Diversification

Diversify your investments to mitigate risks associated with interest rate changes. Consider a balanced mix of stocks, bonds, and other assets to optimize returns while managing risk.

Consulting Financial Advisors

Seek advice from qualified financial advisors who can provide personalized guidance tailored to your financial goals and risk tolerance. Their expertise can help you make informed decisions in a complex financial environment.

Conclusion

Interest rates today are a fundamental component of the financial system, influencing borrowing, saving, and investing decisions. By understanding the factors that affect interest rates and their implications on various financial products, individuals and businesses can make informed choices to secure their financial futures.

We encourage you to take action by reviewing your financial plans, adjusting your strategies, and staying informed about interest rate trends. Share your thoughts in the comments below or explore other articles on our site for additional insights into the world of finance.