As Tax Day 2025 approaches, individuals and businesses must gear up for the annual tax filing deadline. With the IRS introducing new guidelines and regulations for the upcoming year, staying informed about these changes is essential to avoid penalties and optimize deductions and credits. This article provides an in-depth look at what you need to know about Tax Day 2025, from deadlines to strategies for maximizing your returns.

Whether you're new to filing taxes or an experienced taxpayer, staying updated on Tax Day 2025 is crucial. The Internal Revenue Service (IRS) frequently updates its policies, and keeping abreast of these changes can save you time, money, and potential legal complications. In the sections below, we'll explore the essential aspects of Tax Day 2025, ensuring you're well-prepared.

This guide aims to offer actionable insights and practical advice to help you navigate the complexities of tax filing. From understanding the significance of Tax Day to exploring strategies for maximizing deductions and credits, we'll cover everything you need to know to make the process smoother. Let's get started!

Read also:Exploring The Multifaceted Career Of Carl Erik Rinsch

Table of Contents

- Understanding Tax Day

- Key Dates and Deadlines for Tax Day 2025

- Updated IRS Guidelines for Tax Day 2025

- Options for Filing Taxes in 2025

- Maximizing Your Deductions and Credits

- Consequences of Late Filing

- Avoiding Common Tax Filing Errors

- Resources to Support Taxpayers

- Effective Tax Planning Strategies

- Conclusion and Recommendations

Understanding Tax Day

Tax Day represents the annual deadline by which individuals and businesses in the United States must file their federal income tax returns with the IRS. Typically falling on April 15th, this date may vary slightly depending on weekends or holidays. Missing this deadline can result in penalties and interest charges, underscoring its importance for taxpayers nationwide.

Origins of Tax Day

The concept of Tax Day dates back to 1913 when the 16th Amendment to the U.S. Constitution was ratified, granting Congress the authority to impose an income tax. Since then, the IRS has established specific deadlines for tax filings, which have evolved over time. Understanding the historical context of Tax Day highlights the significance of timely compliance with tax obligations.

Key Dates and Deadlines for Tax Day 2025

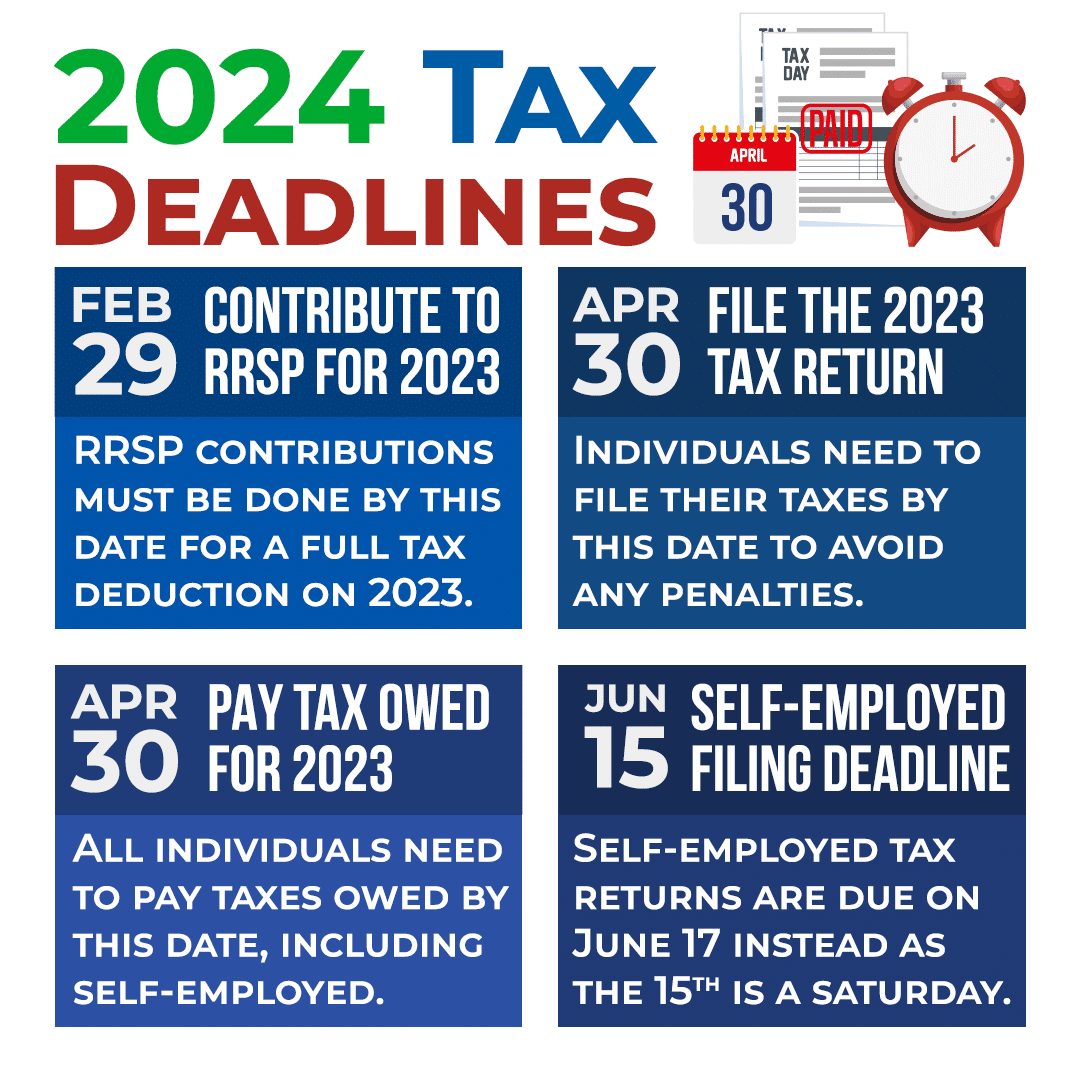

Tax Day 2025 is set for April 15th, 2025. However, it's important to note that some states or regions may have different deadlines due to local holidays or extensions. For instance, if April 15th falls on a weekend or holiday, the IRS might extend the deadline to the next business day.

Important Dates to Keep in Mind

- April 15th, 2025: Federal Tax Filing Deadline

- March 1st, 2025: Deadline for Employers to Provide W-2 Forms

- June 15th, 2025: Extended Filing Deadline for Taxpayers Who Request Extensions

Staying aware of these dates ensures you have sufficient time to gather necessary documents and complete your tax return accurately, minimizing the risk of errors or missed deadlines.

Updated IRS Guidelines for Tax Day 2025

Each year, the IRS releases updated guidelines to reflect changes in tax laws and regulations. For Tax Day 2025, taxpayers should familiarize themselves with the following key updates:

- Higher Standard Deduction Limits

- Adjusted Income Tax Brackets

- Revised Eligibility Criteria for Credits and Deductions

These updates aim to streamline the tax filing process while promoting fairness and transparency. Reviewing the IRS guidelines early can help you prepare effectively for the upcoming tax season.

Read also:Exploring The Heart And Soul Of Alabama Baseball

Options for Filing Taxes in 2025

Taxpayers have multiple options for filing their returns for Tax Day 2025:

Electronic Filing (e-File)

Electronic filing is the most efficient and accurate method for submitting tax returns. It reduces the likelihood of errors and enables taxpayers to receive refunds faster. Popular tax software programs like TurboTax and H&R Block offer e-filing services, making the process convenient and accessible.

Paper Filing

For those who prefer a traditional approach, paper filing remains an option. However, it may take longer to process and increases the risk of errors. If you choose this method, ensure all forms are completed accurately and submitted by the deadline to avoid complications.

Maximizing Your Deductions and Credits

One of the most effective ways to reduce your tax liability is by taking full advantage of available deductions and credits. For Tax Day 2025, consider the following strategies:

Standard Deduction

The standard deduction for 2025 is expected to increase, offering taxpayers greater savings. Both single filers and married couples filing jointly can benefit from this adjustment, simplifying the process of reducing taxable income.

Child Tax Credit

Eligible taxpayers can claim the Child Tax Credit, which significantly lowers tax liability for families with dependent children. Understanding the eligibility requirements is essential to maximize this valuable credit and ensure compliance.

Consequences of Late Filing

Failing to meet the Tax Day 2025 deadline can result in penalties and interest charges. The IRS imposes a failure-to-file penalty of 5% of the unpaid taxes for each month the return is late, up to a maximum of 25%. Additionally, interest accrues on any unpaid balance, compounding the financial burden.

To avoid these penalties, consider filing for an extension if you're unable to meet the deadline. An extension grants you an additional six months to submit your return without incurring late filing penalties, providing much-needed relief during busy tax seasons.

Avoiding Common Tax Filing Errors

Mistakes on your tax return can lead to delays, penalties, or even audits. Below are some common errors to watch out for:

- Incorrect Social Security Numbers

- Misspelled Names

- Forgetting to Sign the Return

- Incorrect Income Reporting

Carefully reviewing your return before submission can prevent unnecessary complications. Using tax software or consulting a tax professional can further reduce the risk of errors, ensuring your return is accurate and compliant.

Resources to Support Taxpayers

The IRS offers a variety of resources to assist taxpayers in preparing for Tax Day 2025:

IRS Website

The official IRS website serves as a comprehensive resource for tax laws, forms, and guidelines. It provides answers to frequently asked questions and keeps taxpayers informed about the latest developments, making it an invaluable tool for preparation.

Tax Professionals

For complex tax situations, consulting a certified public accountant (CPA) or enrolled agent (EA) can provide expert guidance. These professionals specialize in tax planning and can help navigate the intricacies of Tax Day 2025, ensuring compliance and optimizing returns.

Effective Tax Planning Strategies

Proactive tax planning is key to minimizing your tax liability and maximizing your returns. Consider implementing the following strategies:

- Contributing to Retirement Accounts

- Utilizing Health Savings Accounts (HSAs)

- Investing in Tax-Advantaged Vehicles

Starting these strategies early in the year can yield significant benefits when Tax Day 2025 arrives, helping you achieve greater financial stability and peace of mind.

Conclusion and Recommendations

Tax Day 2025 is a critical deadline for all taxpayers, and preparation is key to avoiding penalties and maximizing your returns. By understanding the key dates, IRS guidelines, and available deductions, you can approach the tax filing process with confidence. Always review your return carefully and seek professional assistance if needed.

We encourage you to share this article with friends and family who may benefit from the information. For more insights on tax planning and financial management, explore our other resources on the website. Feel free to leave a comment below if you have any questions or feedback!