What Are Student Loans?

A student loan is a financial tool designed to help students cover the costs associated with higher education. These costs can include tuition fees, books, housing, and other educational expenses. Unlike scholarships and grants, student loans must be repaid, typically with interest. Understanding the intricacies of student loans is essential for students and their families to make informed decisions about financing their education.

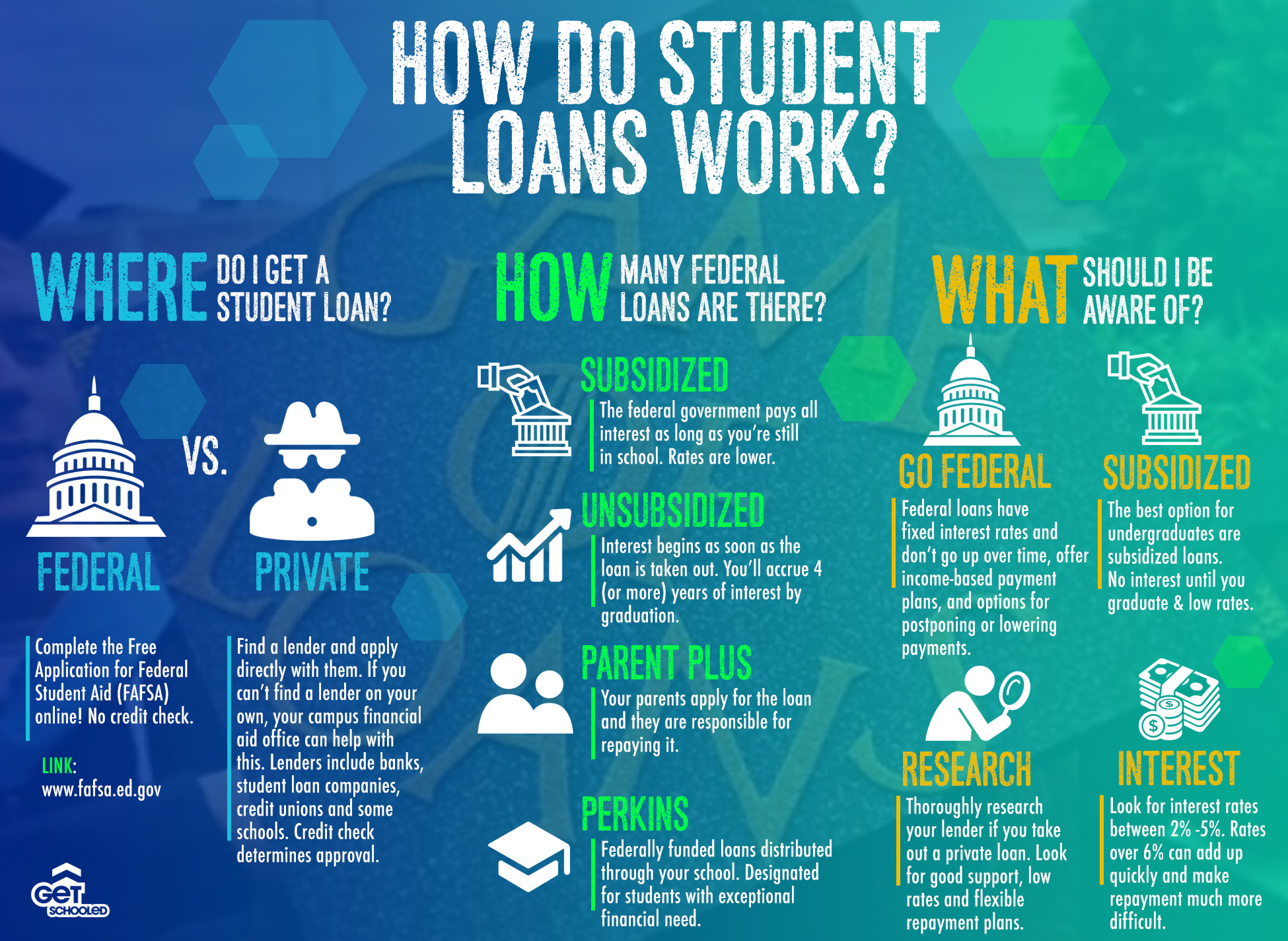

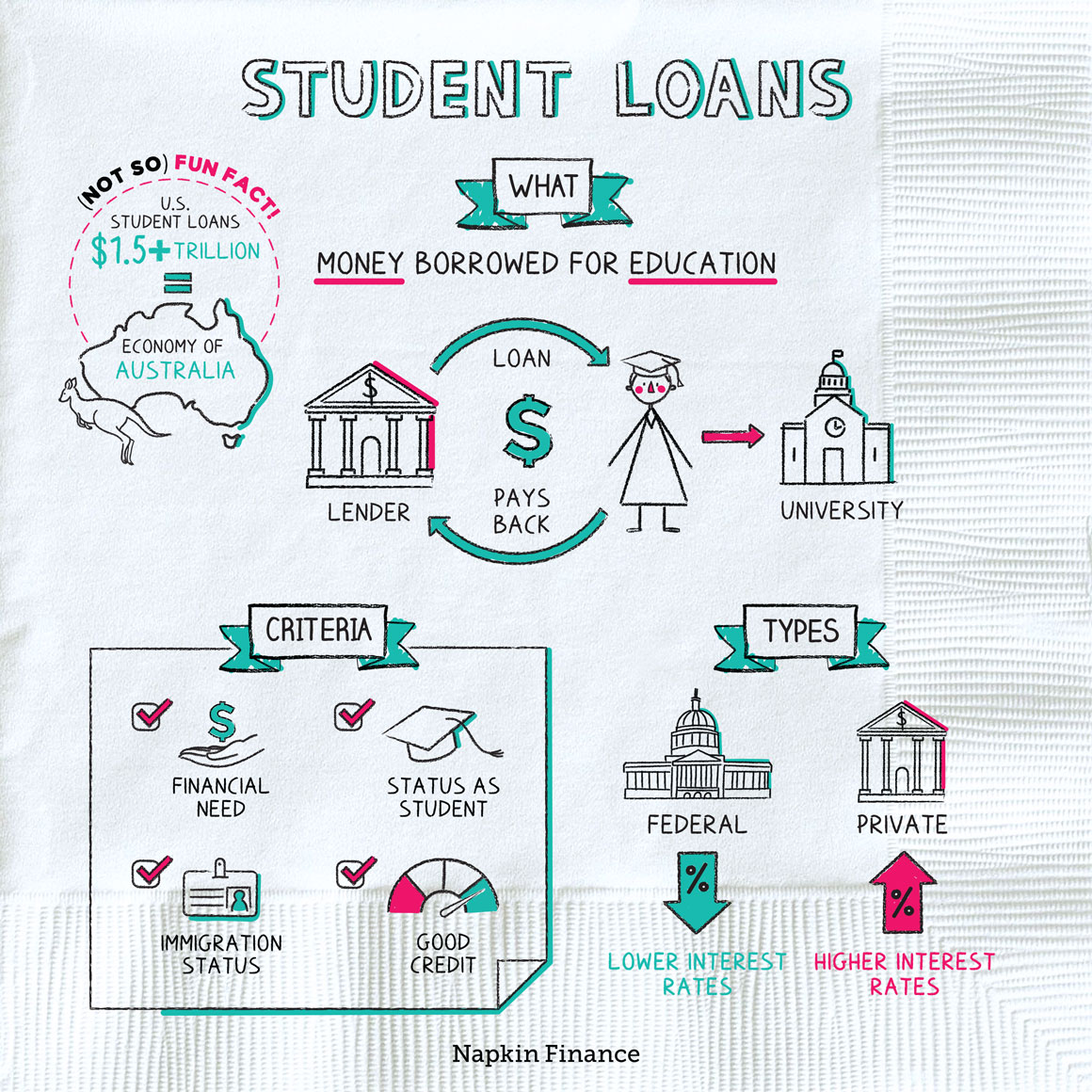

Types of Student Loans

There are several types of student loans available, each with its own set of features and benefits. Federal student loans, offered by the government, often come with lower interest rates and more flexible repayment options. Private student loans, on the other hand, are provided by banks, credit unions, and other financial institutions. These loans may have variable interest rates and stricter repayment terms. It's important to evaluate your financial situation and educational goals before choosing the right type of loan for your needs.

Eligibility Criteria for Student Loans

Eligibility for student loans depends on various factors, including your academic status, financial need, and citizenship. For federal loans, students must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility. Private loans may require a credit check and, in some cases, a co-signer. Understanding the eligibility requirements can help you prepare the necessary documentation and increase your chances of securing the funding you need.

Read also:King Charles A Modern Monarch Redefining Tradition And Progress

Repayment Options for Student Loans

Repaying student loans can be a significant financial commitment, but there are several options available to make the process more manageable. Income-driven repayment plans adjust your monthly payments based on your income and family size, providing relief to borrowers with financial hardships. Loan consolidation allows you to combine multiple loans into one, simplifying repayment and potentially lowering your monthly payments. Additionally, some borrowers may qualify for loan forgiveness programs, which can reduce or eliminate their debt after a certain period of service or employment in specific fields.

Strategies for Managing Student Loan Debt

Effectively managing student loan debt requires careful planning and discipline. Start by creating a budget that accounts for your monthly loan payments, ensuring you allocate sufficient funds to avoid default. Consider making extra payments whenever possible to reduce the total interest paid over the life of the loan. Additionally, stay informed about any changes in loan terms or repayment options, as these can impact your financial strategy. Seeking advice from financial advisors or counselors can also provide valuable insights and help you navigate the complexities of loan management.

Common Misconceptions About Student Loans

There are several misconceptions surrounding student loans that can lead to poor financial decisions. One common misconception is that student loans are easy to discharge in bankruptcy, which is generally not the case. Another is that private loans are always more expensive than federal loans, but this depends on individual circumstances and interest rates. By dispelling these myths and gaining a deeper understanding of student loans, you can make more informed choices about your education and financial future.