Nike stock has emerged as a leading choice for investors aiming to tap into the thriving global athletic apparel industry. As one of the world's most iconic brands, Nike continues to lead the market with its cutting-edge products and unmatched brand influence. However, understanding the factors that make Nike stock a compelling investment is crucial before committing your capital.

Nike, established in 1964, has evolved from a modest athletic shoe distributor into a global giant in the sports and fitness sector. The company now offers an extensive range of products, including footwear, apparel, and accessories, catering to athletes and fitness enthusiasts globally. A deeper understanding of Nike stock is vital for anyone considering an investment in this dynamic and rapidly growing industry.

This article provides a comprehensive exploration of Nike stock, covering its historical performance, current financial standing, and future growth prospects. By the end of this guide, you will have a thorough understanding of why Nike stock might be an excellent addition to your investment portfolio.

Read also:Chief Justice John Roberts A Pillar Of American Jurisprudence

Table of Contents

- Overview of the Company

- Analyzing Nike Stock Performance

- Key Financial Indicators

- Understanding Market Competitors

- Strategies Driving Growth

- Navigating Risks and Challenges

- Gauging Investor Sentiment

- Exploring Nike's Dividend Policy

- Commitment to Sustainability

- Final Thoughts

Overview of the Company

Nike Inc., headquartered in Beaverton, Oregon, is a global pioneer in the design, development, and marketing of athletic footwear, apparel, and equipment. Since its inception in 1964, Nike has cultivated a reputation for innovation, quality, and performance, establishing itself as one of the most valuable brands worldwide.

Key Milestones

- 1964: Nike begins as Blue Ribbon Sports, founded by Bill Bowerman and Phil Knight.

- 1971: The company officially rebrands as Nike, inspired by the Greek goddess of victory.

- 1980: Nike goes public, offering shares to investors for the first time.

- 2006: Launches the Nike+ platform, marking its entry into the digital fitness market.

Analyzing Nike Stock Performance

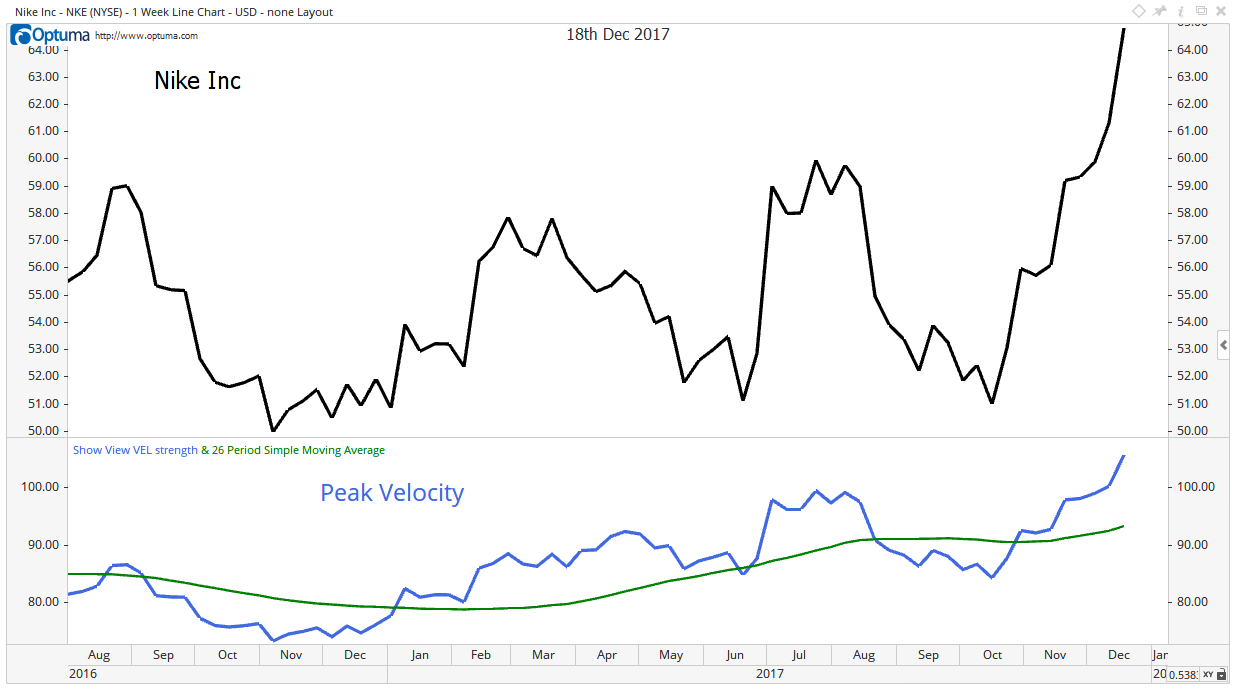

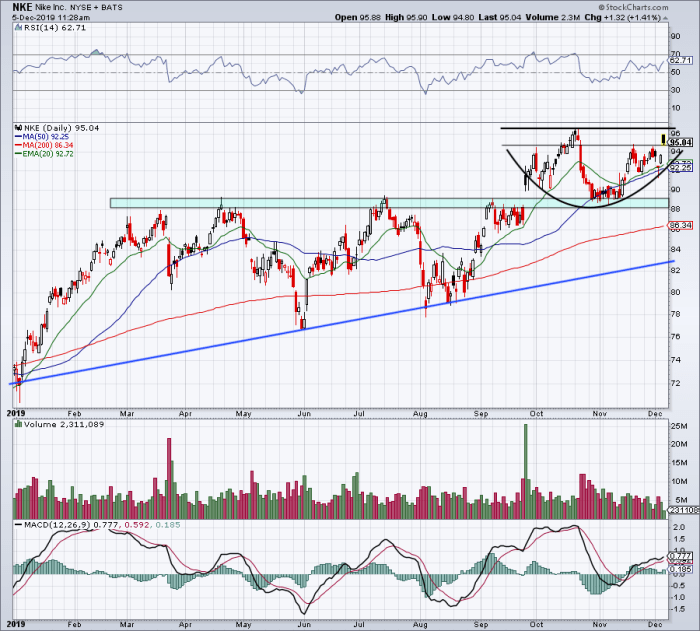

Nike stock has exhibited remarkable growth over the years, reflecting the company's dominance in the athletic apparel sector. Since its initial public offering (IPO) in 1980, Nike stock has delivered impressive returns, making it a popular choice for long-term investment portfolios.

Historical Price Trends

Over the past decade, Nike stock has consistently outperformed major market indices, bolstered by robust revenue growth and expanding profit margins. Despite occasional market fluctuations, Nike's stock has demonstrated resilience, supported by its strong business model and enduring brand loyalty.

Key Financial Indicators

Evaluating Nike stock involves examining several critical financial metrics, including revenue growth, earnings per share (EPS), and price-to-earnings (P/E) ratio. These metrics offer valuable insights into the company's financial health and growth potential, enabling investors to make informed decisions.

Revenue Growth

Nike's revenue has steadily increased over the years, driven by expanding product lines and aggressive international expansion. In the fiscal year 2022, Nike reported revenue of $46.7 billion, marking a year-over-year increase of 5%. This growth underscores the company's ability to adapt and thrive in a competitive market environment.

Understanding Market Competitors

Nike operates in a highly competitive landscape, facing formidable rivals such as Adidas, Puma, and Under Armour. Assessing Nike's competitive positioning is essential for evaluating its market share and growth opportunities.

Read also:Gerardo Ortiz A Prominent Figure In Regional Mexican Music

Competitive Advantages

- Brand Equity: Nike's widespread brand recognition provides a significant competitive edge, setting it apart from its peers.

- Innovation: The company's unwavering commitment to innovation ensures its products remain at the forefront of athletic performance and consumer demand.

- Global Reach: Nike's extensive distribution network allows it to connect with customers across the globe, reinforcing its position as a market leader.

Strategies Driving Growth

Nike employs a multifaceted approach to drive growth and maintain its leadership in the athletic apparel market. These strategies encompass expanding product offerings, enhancing digital capabilities, and strengthening its international presence.

Digital Transformation

Nike has made substantial investments in digital technologies, including e-commerce platforms and mobile applications, to improve customer engagement and optimize operations. This focus on digital innovation positions Nike strategically for sustained growth in the ever-evolving retail landscape.

Navigating Risks and Challenges

While Nike stock presents significant growth potential, investors must also consider the risks and challenges associated with the company. These include macroeconomic uncertainties, supply chain disruptions, and escalating competition.

Supply Chain Risks

Nike's global operations expose it to risks related to supply chain disruptions, such as transportation delays and raw material shortages. To mitigate these risks, Nike has diversified its supplier network and enhanced logistics efficiency, ensuring continuity in its operations.

Gauging Investor Sentiment

Investor sentiment toward Nike stock remains overwhelmingly positive, driven by the company's robust financial performance and promising growth prospects. Both analysts and institutional investors view Nike as a reliable long-term investment, supported by its robust business model and enduring brand strength.

Analyst Ratings

According to a recent survey of financial analysts, the majority recommend purchasing Nike stock, highlighting its potential for continued growth and innovation. However, it is crucial for investors to conduct thorough research and consult with financial advisors before making investment decisions.

Exploring Nike's Dividend Policy

Nike offers a quarterly dividend to its shareholders, providing an additional incentive for long-term investors. The company's dividend policy reflects its dedication to rewarding shareholders while preserving sufficient capital for growth initiatives.

Dividend Yield

As of the latest dividend payment, Nike's dividend yield stands at approximately 1.2%, offering a modest yet consistent income stream for investors. While the yield may not match that of some high-yield dividend stocks, it aligns with Nike's strategy of reinvesting profits into future growth opportunities.

Commitment to Sustainability

Nike is deeply committed to sustainability, implementing various initiatives to minimize its environmental impact and promote social responsibility. These efforts not only enhance the company's reputation but also contribute to long-term value creation for shareholders.

Environmental Initiatives

Nike has set ambitious goals to reduce its carbon footprint and increase the use of sustainable materials in its products. The company's "Move to Zero" campaign aims to achieve zero carbon emissions and zero waste, showcasing its dedication to environmental stewardship and sustainable business practices.

Final Thoughts

Nike stock represents an excellent investment opportunity for those seeking to capitalize on the growth of the global athletic apparel market. With its strong brand, innovative products, and unwavering commitment to sustainability, Nike is well-positioned for continued success in the years ahead.

We encourage readers to share their insights and experiences with Nike stock in the comments section below. Additionally, feel free to explore other articles on our website for further insights into the world of investing. Thank you for reading, and we hope this guide has been both informative and valuable to you!

References:

- Nike Inc. Annual Report 2022

- Statista: Nike Revenue Statistics

- Forbes: Nike's Digital Transformation

- Reuters: Analyst Ratings for Nike Stock