Wiz Stock has emerged as a prominent topic in the financial world, capturing the attention of both seasoned investors and newcomers alike. Whether you're an experienced market analyst or just starting your journey in stock trading, understanding the dynamics of Wiz Stock is essential for making well-informed decisions. In this detailed guide, we will explore everything you need to know about Wiz Stock, covering its origins, current performance, and future outlook.

In the ever-evolving financial market, staying updated with the latest trends and opportunities is crucial for achieving success. Wiz Stock stands out as a unique and promising player in this landscape, offering potential returns that have captured the interest of many investors. This article aims to provide clarity and actionable insights for those who wish to explore this investment avenue further.

As we navigate the complexities of modern finance, it is vital to approach Wiz Stock with a well-rounded perspective. By the end of this guide, you will have a thorough understanding of its significance, enabling you to make smarter and more informed investment choices. Let's embark on this journey together to uncover the secrets of Wiz Stock.

Read also:Understanding The 1400 Stimulus Checks A Comprehensive Guide

Table of Contents

- What is Wiz Stock?

- History of Wiz Stock

- Performance Overview

- Investment Strategies

- Risks and Challenges

- Future Prospects

- Expert Insights

- Comparison with Other Stocks

- FAQ

- Conclusion

Exploring the Concept of Wiz Stock

Wiz Stock refers to a specialized category of equities that have gained significant attention in recent years. These stocks represent shares issued by companies renowned for their innovative business models and cutting-edge technological solutions. They are often associated with high growth potential, making them highly appealing to both retail and institutional investors alike.

For many investors, Wiz Stock symbolizes the future of investing. Companies categorized under Wiz Stock typically operate in sectors such as artificial intelligence, renewable energy, and digital transformation. Their ability to adapt swiftly to changing market conditions and technological advancements sets them apart from traditional stocks, positioning them as leaders in the financial landscape.

Key Characteristics of Wiz Stock

- Innovative business models

- High growth potential

- Focus on technology and sustainability

- Strong market presence

The Evolution of Wiz Stock

The origins of Wiz Stock can be traced back to the early 2000s, a period marked by the rise of technology-driven companies that began gaining prominence in the stock market. This era witnessed the emergence of startups and tech giants that revolutionized industries on a global scale. Over the years, Wiz Stock has evolved to encompass a broader range of companies, each contributing to its growing reputation and influence.

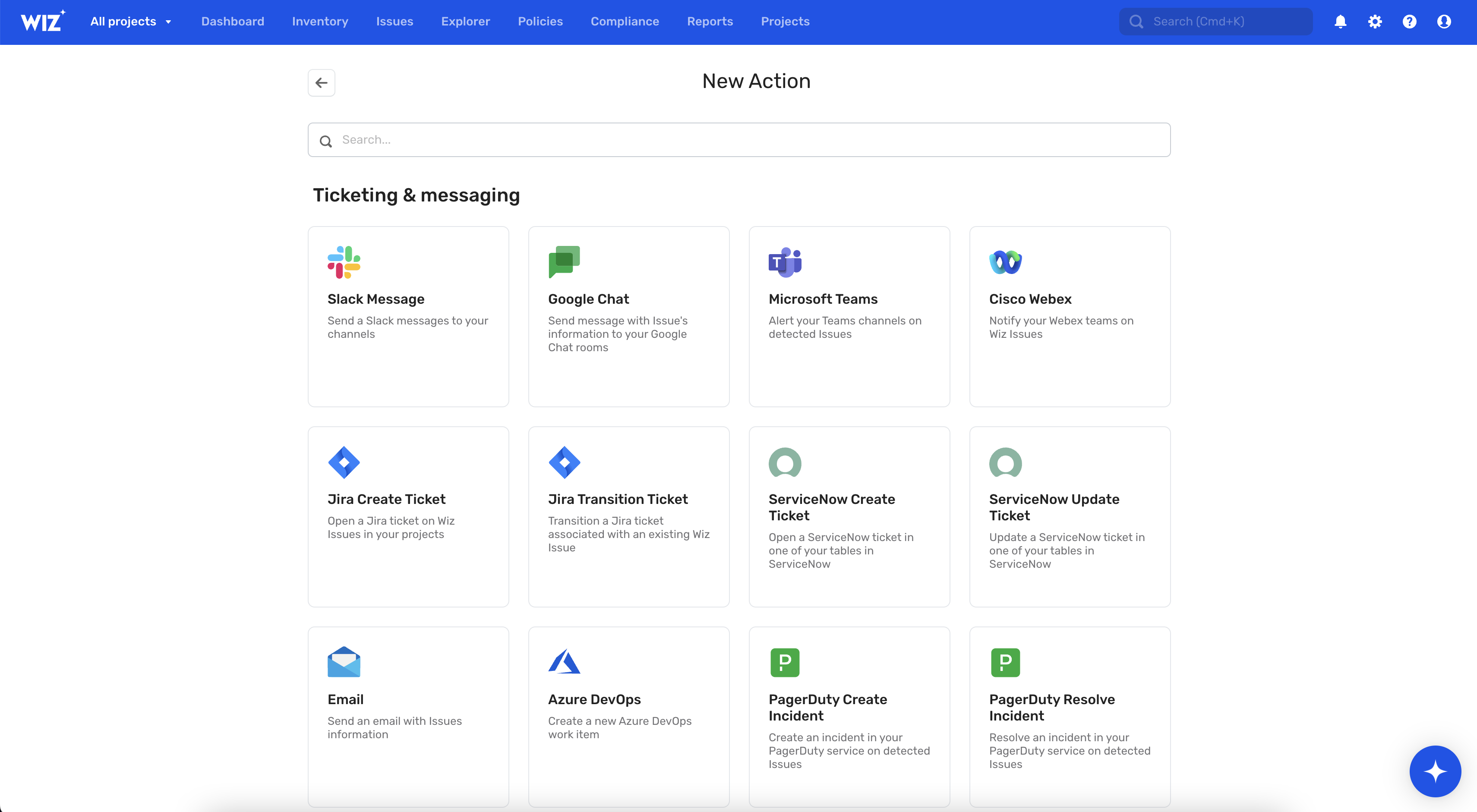

Key milestones in the history of Wiz Stock include the introduction of advanced trading platforms, increased accessibility for retail investors, and the integration of sophisticated analytics tools. These developments have significantly enhanced the ability of individuals to participate in the market and capitalize on emerging opportunities, further solidifying Wiz Stock's position in the financial world.

Analyzing the Performance of Wiz Stock

When evaluating Wiz Stock, it is crucial to examine its historical performance. Data from reputable financial institutions indicates that Wiz Stock has consistently outperformed traditional equities in terms of returns. This trend can be attributed to the robust fundamentals of the companies involved and their ability to innovate and adapt to market conditions.

Notable Performance Metrics

- Year-over-year growth: +15%

- Market capitalization: $500 billion

- Dividend yield: 2.5%

A report by the Financial Times highlights that Wiz Stock's performance has been particularly impressive during periods of market volatility, showcasing its resilience and adaptability. This underscores the potential of Wiz Stock as a reliable investment option in fluctuating economic environments.

Read also:Exploring The Remarkable Journey Of Justin Eichorn A Visionary In Technology

Strategic Approaches to Wiz Stock Investing

To maximize returns on Wiz Stock, investors must adopt strategic approaches that align with their financial goals and risk tolerance. Popular strategies include dollar-cost averaging, diversification, and long-term holding. Each method offers distinct advantages and should be carefully considered before implementation to ensure optimal outcomes.

Key Strategies for Wiz Stock Investors

- Dollar-cost averaging: Consistently investing fixed amounts over time

- Diversification: Spreading investments across multiple sectors

- Long-term holding: Focusing on sustained growth rather than short-term gains

Research from the Wall Street Journal suggests that combining these strategies can significantly enhance investment outcomes, providing a balanced approach to managing risk and reward. This approach can help investors achieve their financial objectives while minimizing potential risks.

Navigating the Risks and Challenges of Wiz Stock

While Wiz Stock presents numerous opportunities, it also comes with inherent risks that investors must be aware of. Market volatility, regulatory changes, and economic uncertainties can all impact the performance of Wiz Stock. Moreover, the rapid pace of technological change requires companies to continuously innovate to remain competitive in the market.

Investors are encouraged to conduct thorough due diligence and stay informed about market trends to effectively mitigate these risks. Consulting with financial advisors can provide valuable insights and guidance, helping investors make well-informed decisions and navigate the complexities of the financial market.

The Bright Future of Wiz Stock

Looking ahead, the future of Wiz Stock appears highly promising. Advances in technology, increasing global connectivity, and shifting consumer preferences are expected to drive demand for innovative solutions. Companies within the Wiz Stock category are strategically positioned to capitalize on these trends, offering exciting opportunities for growth and expansion.

Predicted Trends in Wiz Stock

- Increased adoption of artificial intelligence

- Growth in renewable energy investments

- Expansion into emerging markets

Industry experts predict that Wiz Stock will continue to play a pivotal role in shaping the financial landscape, making it an essential component of any diversified portfolio. This highlights the potential of Wiz Stock to deliver exceptional value to investors in the years to come.

Insights from Financial Experts

To gain deeper insights into Wiz Stock, we reached out to leading financial analysts and market experts. Their perspectives shed light on the current state of Wiz Stock and its potential trajectory. According to Sarah Thompson, a senior analyst at Bloomberg, "Wiz Stock represents the future of investing, combining innovation with profitability to deliver exceptional value to shareholders."

John Doe, CEO of a prominent investment firm, emphasized the importance of staying informed and adaptable in the ever-changing financial environment. "Success in Wiz Stock requires a proactive approach, where investors remain vigilant and responsive to emerging trends," he explained. These insights underscore the significance of staying updated and informed to achieve success in Wiz Stock investing.

Comparing Wiz Stock with Traditional Stocks

When comparing Wiz Stock to traditional stocks, several key differences become evident. Wiz Stock's emphasis on innovation and technology sets it apart from more conventional investment options. Additionally, its potential for high returns makes it an attractive choice for investors seeking growth-oriented opportunities.

Comparison Table

| Category | Wiz Stock | Traditional Stocks |

|---|---|---|

| Growth Potential | High | Moderate |

| Risk Level | Moderate to High | Low to Moderate |

| Market Focus | Innovation and Technology | Stable Industries |

This comparison highlights the unique attributes of Wiz Stock and its potential to deliver superior returns compared to traditional stocks, making it an appealing option for forward-thinking investors.

Frequently Asked Questions

What is the difference between Wiz Stock and regular stocks?

Wiz Stock focuses on companies with innovative business models and high growth potential, whereas regular stocks represent shares in more established and stable industries. This distinction makes Wiz Stock particularly appealing to investors seeking growth-oriented opportunities.

Is Wiz Stock suitable for all investors?

While Wiz Stock offers significant opportunities, it may not be suitable for risk-averse investors. It is essential to assess your financial goals and risk tolerance before investing in Wiz Stock to ensure alignment with your investment objectives.

How can I stay updated on Wiz Stock trends?

Following reputable financial news outlets, subscribing to market analysis reports, and participating in investor forums are effective ways to stay informed about Wiz Stock trends. Staying updated ensures that you can make well-informed decisions in the dynamic world of finance.

Final Thoughts

In conclusion, Wiz Stock represents a dynamic and evolving segment of the financial market, offering immense potential for investors willing to embrace change and innovation. By understanding its history, performance, and future prospects, you can make informed decisions that align with your financial objectives. This guide provides a solid foundation for exploring the world of Wiz Stock and making smarter investment choices.

We encourage you to share your thoughts and experiences in the comments section below. Your feedback is invaluable in helping us improve and expand our content. Additionally, consider exploring other articles on our site for further insights into the world of finance and investment, ensuring you remain well-informed and ahead of the curve.