In the fast-evolving landscape of technology, Nvidia's recent unveiling of its latest AI chips has sparked significant reactions in the stock market, leading to a noticeable decline in the company's share prices. As a pioneer in artificial intelligence and graphics processing, Nvidia continues to set industry benchmarks with its cutting-edge innovations. However, the mixed reactions from investors have resulted in a downturn for Nvidia's stock. In this exploration, we will examine the factors driving this trend and assess what it implies for the company, its stakeholders, and the broader tech sector.

Stock market fluctuations for Nvidia are not unusual, considering its leadership role in the tech industry. The company remains a trailblazer in the AI space, shaping industries globally with its technological advancements. Nevertheless, the recent dip in stock prices prompts critical questions about investor confidence and Nvidia's future direction. Understanding these dynamics is essential to appreciating the company's role in the AI revolution.

This article will analyze the reasons behind the decline in Nvidia shares following the AI chip announcements, explore the broader implications for the market, and provide insights into what lies ahead for investors and tech enthusiasts. By delving deeper into the nuances of this development, we can better comprehend Nvidia's influence on the future of AI technology.

Read also:The Remarkable Rise Of The Tate Brothers In The Music Industry

Exploring Nvidia's Leadership in AI Chips

Why Nvidia Dominates the AI Chip Sector

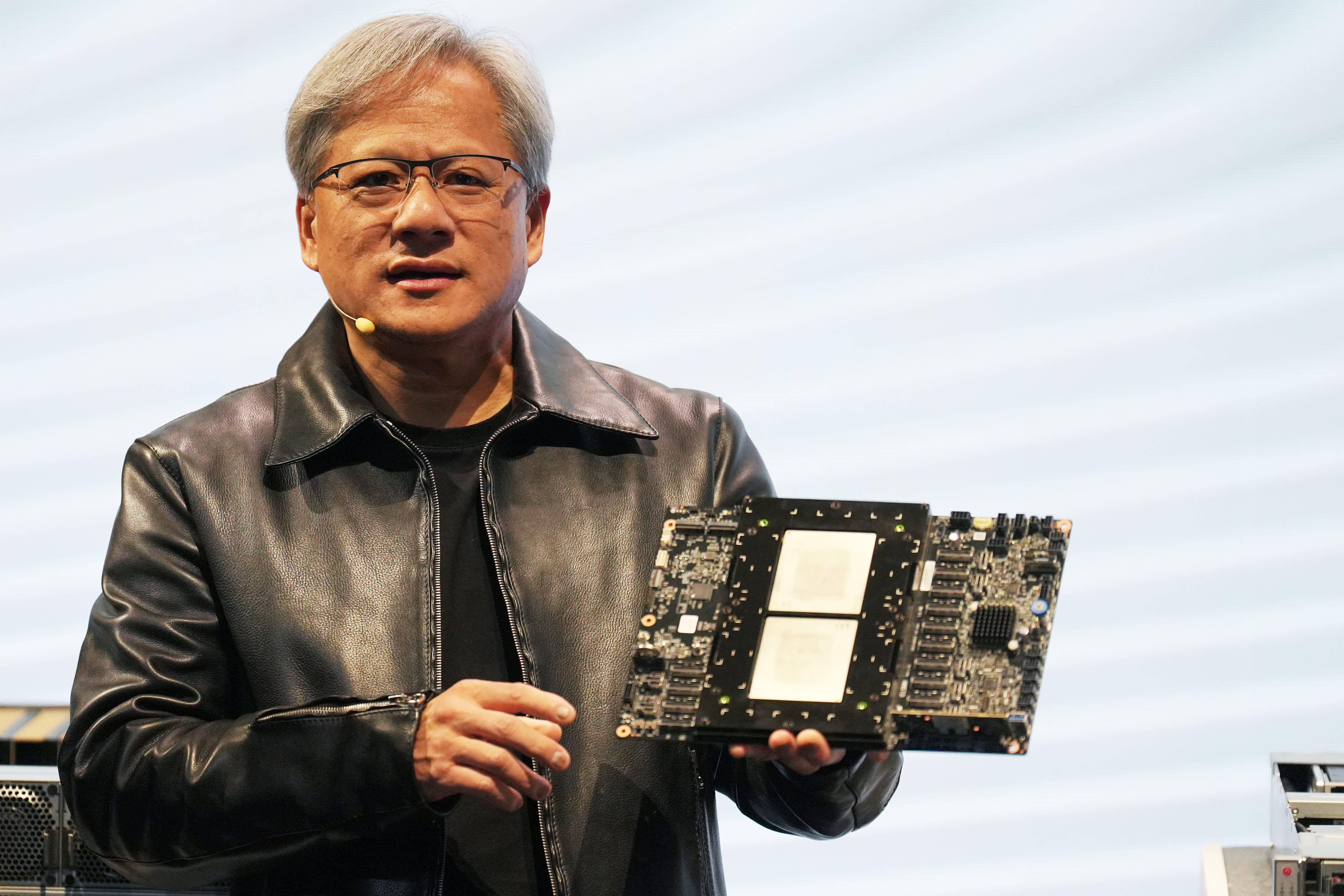

Nvidia's preeminent position in the AI chip market is the result of sustained investment in research and development, consistently pushing the boundaries of what is achievable with graphics processing units (GPUs). These GPUs are not only vital for gaming but also serve as the backbone for AI applications, enabling complex computations and machine learning tasks. Nvidia's ability to innovate consistently has solidified its reputation as a leader in the tech world.

Data from Statista reveals that Nvidia commands approximately 80% of the discrete GPU market, highlighting its dominance. This market share is sustained by its commitment to innovation, strategic partnerships with top-tier tech companies, and a robust lineup of products designed to meet the evolving demands of the AI era. Nvidia's focus on delivering cutting-edge solutions ensures its continued relevance in the data-driven world.

Key Advancements in Nvidia's Latest AI Chips

The latest AI chips introduced by Nvidia promise groundbreaking improvements in both performance and efficiency. Notable features include:

- Substantial computational power for deep learning models, enhancing the capabilities of AI systems.

- Enhanced energy efficiency, contributing to reduced carbon emissions from data centers and promoting sustainability.

- Support for a wide array of AI applications, ranging from autonomous vehicles to advanced healthcare diagnostics.

These advancements position Nvidia as a pivotal player in the AI revolution, ensuring its significance in an increasingly data-centric world.

Market Dynamics Following Nvidia's AI Chip Announcements

Investor Sentiment Post-Announcement

Despite the impressive capabilities of Nvidia's new AI chips, the market's initial reaction was somewhat muted. Nvidia shares experienced a decline following the announcements, with analysts attributing this drop to various factors. One significant concern is the intensifying competition in the AI chip market, as companies like AMD and Intel intensify their efforts to challenge Nvidia's supremacy.

Moreover, investors may be cautious about Nvidia's high stock valuation, which has surged significantly in recent years. The fear of a potential bubble might deter some from further investment, adding pressure to the share prices and contributing to their decline.

Read also:Exploring The Remarkable Journey Of Justin Eichorn A Visionary In Technology

Factors Contributing to the Decline in Stock Prices

Several factors have played a role in the decline of Nvidia shares:

- Competition: As noted earlier, the AI chip market is becoming increasingly competitive with new entrants challenging Nvidia's dominance.

- Macroeconomic Concerns: Broader economic uncertainties, including inflation and interest rate adjustments, have affected investor sentiment.

- Supply Chain Challenges: Persistent issues in the semiconductor supply chain have raised doubts about Nvidia's capacity to meet demand.

These factors, combined with the inherent volatility of the tech sector, have influenced the current state of Nvidia's stock performance.

The Broader Implications for the Tech Industry

AI Chips: Shaping the Future of Technology

The evolution of AI chips is critical to advancing technology across various sectors. Nvidia's contributions to this field have far-reaching consequences, influencing everything from autonomous vehicles to sophisticated healthcare solutions. The company's latest AI chips are expected to accelerate these advancements, fostering innovation and efficiency in industries heavily reliant on AI.

However, the decline in Nvidia shares following the announcements raises questions about the market's readiness to fully embrace these advancements. While the long-term potential of AI chips is undeniable, short-term market fluctuations can impact investor confidence and the pace of adoption.

Competitor Responses and Market Dynamics

As Nvidia continues to innovate, its competitors are responding swiftly. Companies like AMD and Intel are heavily investing in their AI chip technologies, aiming to seize a larger share of the market. This competitive environment is likely to drive further innovation, benefiting consumers and industries alike.

However, it also underscores the challenges Nvidia faces in retaining its leadership position. The company must continue to innovate and differentiate itself to remain competitive in a crowded market.

Expert Insights on Nvidia's Prospects

Analyst Views on Nvidia's Stock Performance

Analysts hold differing views on Nvidia's future prospects. Some believe the decline in shares is a temporary setback, driven by short-term market conditions. Others caution that increasing competition and macroeconomic challenges could pose significant risks to Nvidia's growth trajectory.

A report by Bloomberg emphasizes the importance of Nvidia's adaptability to changing market dynamics. The company's history of innovation and strategic partnerships provides a solid foundation for successfully navigating these challenges.

Long-Term Growth Opportunities

Despite the current decline in shares, many experts remain optimistic about Nvidia's long-term growth potential. The company's focus on AI and its expanding presence in emerging markets position it favorably for future success. Additionally, its dedication to sustainability and energy efficiency aligns with global trends, making it more appealing to environmentally conscious investors.

Strategies for Investors Considering Nvidia Stock

Evaluating Risk and Reward

For investors contemplating Nvidia stock, it's crucial to evaluate the balance between risk and reward. While the current decline in shares may be concerning, it's important to remember Nvidia's proven ability to overcome market challenges and deliver strong returns over time.

Investors should consider factors such as the company's financial health, competitive landscape, and long-term growth prospects when making investment decisions. Diversifying portfolios and staying informed about market trends can help mitigate risks and enhance returns.

Timing Your Investment

Timing is essential when investing in volatile stocks like Nvidia. Investors should avoid impulsive decisions based on short-term market fluctuations. Instead, they should focus on the company's fundamentals and long-term potential, viewing downturns as opportunities to acquire shares at more favorable prices.

The Technological Advancements Driving Nvidia's Success

Breakthroughs in AI Chip Technology

Nvidia's success is largely attributed to its continuous breakthroughs in AI chip technology. The company's substantial investment in research and development has resulted in products that not only meet current demands but also anticipate future needs. This forward-thinking strategy has enabled Nvidia to maintain its competitive edge in a rapidly changing market.

Key innovations include:

- Development of specialized AI accelerators tailored for diverse applications.

- Integration of advanced cooling technologies to enhance chip performance.

- Collaboration with leading tech companies to develop customized solutions for specific industries.

Expanding Uses of AI Chips

The applications of Nvidia's AI chips continue to grow, driven by technological advancements and increasing demand from various sectors. From powering autonomous vehicles to improving medical imaging, these chips are revolutionizing industries and enhancing lives worldwide.

As the demand for AI-driven solutions expands, Nvidia's role in this transformation becomes increasingly critical, reinforcing its position as a leader in the tech industry.

Challenges Nvidia Faces in the AI Chip Market

Competition and Market Saturation

One of the primary challenges confronting Nvidia is the growing competition in the AI chip market. As more companies enter the space, the risk of market saturation increases, potentially affecting Nvidia's market share and profitability. To address this challenge, Nvidia must continue to innovate and distinguish its products, ensuring they remain the preferred choice for AI applications.

Additionally, Nvidia must navigate the complexities of global trade and regulatory environments, which can impact its operations and supply chain.

Technological and Economic Uncertainties

Technological advancements and economic uncertainties pose further challenges for Nvidia. Rapid changes in technology can render existing products obsolete, necessitating constant innovation to stay ahead. Economic factors such as inflation and currency fluctuations can also influence the company's financial performance, requiring strategic planning and risk management.

Conclusion and Future Outlook

In summary, the decline in Nvidia shares following the AI chip announcements highlights the complexities of the tech market and the challenges faced by companies at the forefront of innovation. While short-term fluctuations may raise concerns, Nvidia's strong foundation, commitment to innovation, and expanding presence in emerging markets position it well for future success.

We invite readers to share their thoughts and insights in the comments section below. For those eager to learn more about Nvidia and its role in shaping the future of AI, we encourage you to explore our other articles on related topics. Together, let's continue to explore and understand the dynamic world of technology and its impact on our lives.

Table of Contents

- Exploring Nvidia's Leadership in AI Chips

- Market Dynamics Following Nvidia's AI Chip Announcements

- The Broader Implications for the Tech Industry

- Expert Insights on Nvidia's Prospects

- Strategies for Investors Considering Nvidia Stock

- The Technological Advancements Driving Nvidia's Success

- Challenges Nvidia Faces in the AI Chip Market