Young adults across the United States are grappling with a financial emergency that is spiraling out of control. The cost of student loan repayments has surged dramatically, with some borrowers seeing their monthly payments escalate from $500 to an alarming $5000. This dramatic increase in debt has left many millennials in a state of panic, prompting them to turn to platforms like TikTok to voice their frustrations and share their personal stories.

The rising burden of student loan payments is not merely a personal financial challenge; it is a societal issue impacting millions of young adults. Policies during the Trump administration, including changes in interest rates, have significantly contributed to this escalating problem, leaving many millennials deeply concerned about their financial futures.

With no immediate solution in sight, the anxiety surrounding student loan debt continues to grow. This article will explore the underlying causes, the profound effects, and the potential remedies to this crisis, shedding light on why millennials are increasingly worried about their financial well-being.

Read also:Exploring The Excitement Of The First Four March Madness

Table of Contents

- Introduction

- Understanding the Student Loan Crisis

- Impact of Trump's Policies on Student Loans

- Millennials React on TikTok

- Causes of Rising Student Loan Payments

- Effects on Millennials' Financial Lives

- Key Statistics and Data

- Potential Solutions to the Crisis

- The Role of the Government in Addressing the Issue

- Conclusion

Introduction

The student loan crisis has been an ongoing concern for years, but recent developments have intensified the situation. Many millennials are now facing monthly payments that have doubled or even tripled, leaving them struggling to make ends meet. This alarming trend has sparked widespread panic, particularly on social media platforms like TikTok, where users are openly sharing their stories and venting their frustrations.

This article aims to provide a comprehensive exploration of the student loan crisis, focusing on the impact of policies implemented during the Trump era and the resultant panic among millennials. By analyzing the root causes, effects, and potential solutions, we hope to illuminate this pressing issue and encourage meaningful discussions.

Understanding the Student Loan Crisis

Student loans have become a fundamental component of the American education system, with millions of students relying on them to finance their higher education. However, the challenge of repaying these loans has become increasingly daunting for many borrowers, creating a financial burden that affects their daily lives.

What is the Student Loan Crisis?

The student loan crisis refers to the growing challenge of excessive student debt and the difficulties borrowers encounter in repaying their loans. This issue has been exacerbated by rising tuition costs, stagnant wages, and unfavorable loan terms, leaving many borrowers trapped in a cycle of debt.

Who is Affected?

- Millennials who graduated during the economic challenges of the Great Recession

- Recent graduates struggling to secure well-paying jobs in a competitive market

- Parents who co-signed loans for their children, placing additional financial strain on their own lives

Impact of Trump's Policies on Student Loans

During the Trump administration, several policies were introduced that directly impacted student loan borrowers. These changes, coupled with rising interest rates, have contributed to the skyrocketing monthly payments faced by millennials.

Changes in Loan Repayment Plans

One of the most significant changes involved modifications to income-driven repayment plans. These plans are designed to make loan repayments more manageable by capping payments at a percentage of the borrower's income. However, under the Trump administration, eligibility criteria were tightened, leaving many borrowers without access to these vital programs.

Read also:Charles Barkley The Iconic Journey Of A Basketball Legend

Interest Rate Increases

Interest rates on federal student loans increased during the Trump era, making borrowing more expensive for students. This increase has had a compounding effect, leading to higher monthly payments for borrowers and exacerbating the financial strain.

Millennials React on TikTok

TikTok has emerged as a platform where millennials voice their concerns about the rising cost of student loan payments. Users are sharing videos that highlight their struggles, often using humor and creativity to convey their message and connect with others facing similar challenges.

Why TikTok?

TikTok's short-form video format and viral nature make it an ideal platform for raising awareness about social issues. Millennials are leveraging this platform to build a community of support, connect with others facing similar challenges, and advocate for meaningful change.

Causes of Rising Student Loan Payments

Several factors have contributed to the increase in student loan payments, including rising tuition costs, changes in loan terms, and broader economic conditions. These factors have collectively created a financial burden that disproportionately affects young adults.

Rising Tuition Costs

The cost of attending college has increased dramatically over the past few decades, outpacing inflation and wage growth. This trend has forced students to take on larger loans to cover the cost of their education, leaving them with significant debt upon graduation.

Economic Conditions

The economic climate also plays a critical role in the student loan crisis. During periods of economic downturn, borrowers may struggle to find well-paying jobs, making it difficult to repay their loans. The combination of high debt and limited job opportunities creates a challenging environment for millennials.

Effects on Millennials' Financial Lives

The rising cost of student loans has had a profound impact on millennials' financial lives, affecting everything from their ability to buy a home to their retirement savings. The financial strain of student loan debt is reshaping their life choices and long-term financial stability.

Delayed Homeownership

Many millennials are delaying homeownership due to the overwhelming burden of student loan debt. With monthly payments reaching as high as $5000, it is challenging for borrowers to save for a down payment or qualify for a mortgage, further delaying their entry into the housing market.

Impact on Retirement Savings

Student loan debt also affects millennials' ability to save for retirement. With a significant portion of their income allocated to loan repayments, many are unable to contribute to retirement accounts, potentially jeopardizing their financial security in later years.

Key Statistics and Data

Data from reliable sources highlights the severity of the student loan crisis:

- Total student loan debt in the U.S.: Over $1.7 trillion

- Average student loan debt per borrower: $37,000

- Percentage of borrowers behind on payments: 11%

These statistics underscore the urgent need for comprehensive solutions to address the issue and alleviate the financial burden on millions of borrowers.

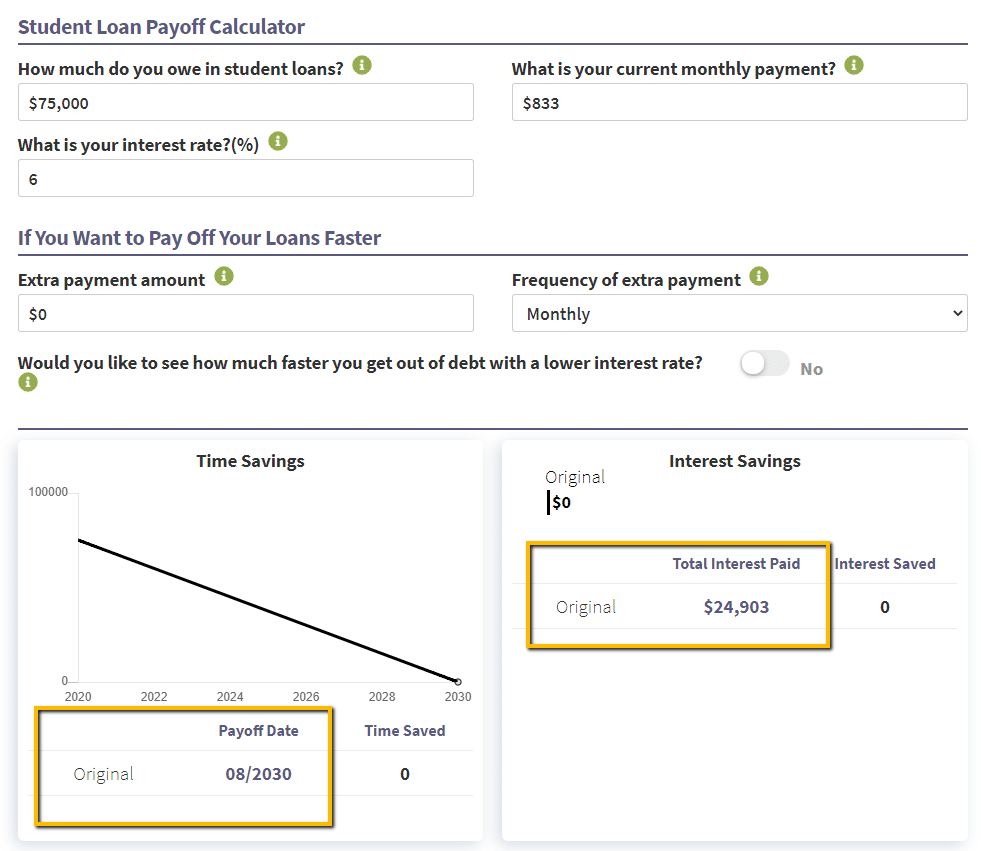

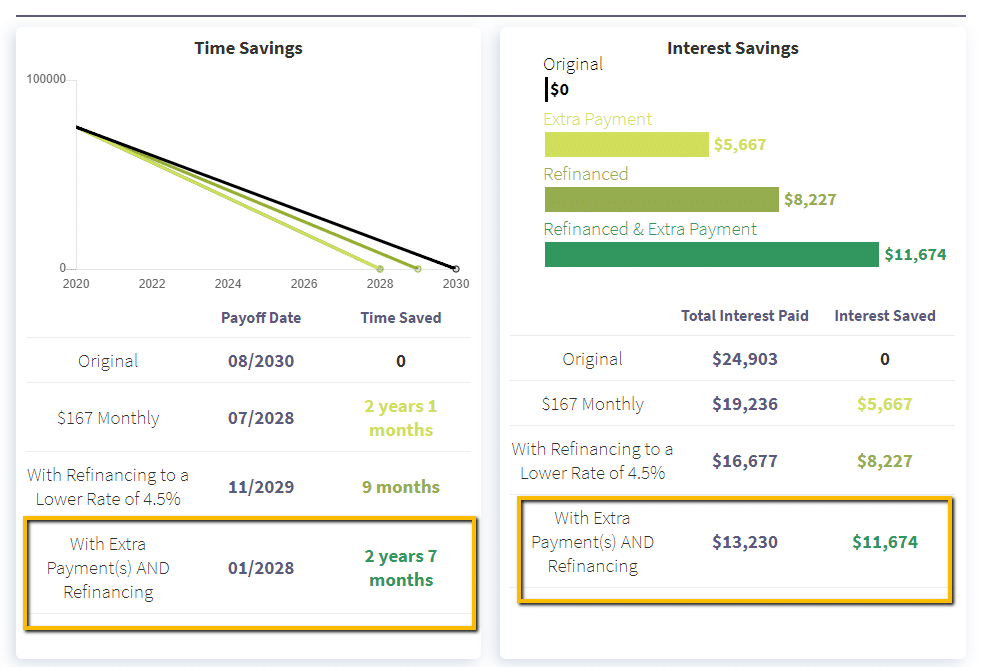

Potential Solutions to the Crisis

Several potential solutions have been proposed to address the student loan crisis:

Student Loan Forgiveness

One solution gaining significant attention is student loan forgiveness. This involves forgiving a portion or all of a borrower's debt, providing much-needed relief to those struggling with high payments. While controversial, this approach could offer immediate financial relief to millions of borrowers.

Reform of Loan Repayment Plans

Reforming income-driven repayment plans to make them more accessible and affordable could also help alleviate the burden on borrowers. Expanding eligibility criteria and adjusting repayment terms based on income levels could enable more individuals to manage their payments effectively.

The Role of the Government in Addressing the Issue

The government plays a pivotal role in addressing the student loan crisis. By implementing policies that prioritize borrowers' needs and promote financial stability, the government can help mitigate the effects of rising debt and create a more equitable system for financing higher education.

Policy Recommendations

Some recommendations for policymakers include:

- Lowering interest rates on federal student loans to reduce the financial burden on borrowers

- Expanding access to income-driven repayment plans to ensure more individuals can manage their payments

- Increasing funding for public education to reduce the reliance on loans and create more affordable educational opportunities

Conclusion

The student loan crisis is a critical issue affecting millions of millennials across the United States. Rising payments, from $500 to $5000, have left many borrowers panicking and seeking support on platforms like TikTok. By understanding the underlying causes, profound effects, and potential solutions, we can work toward a more equitable and sustainable system for financing higher education.

We encourage readers to share their thoughts and experiences in the comments section below. Additionally, consider exploring other articles on our site for more insights into financial wellness and education reform.